China’s Strategic Response to Semiconductor Shortages Amid the U.S.-Led Tariff War

Introduction

China’s semiconductor industry has faced unprecedented challenges due to the U.S.-led tariff war and export controls, which have disrupted global supply chains and intensified geopolitical competition.

In response, Beijing has formulated a multi-dimensional strategy centered on bolstering domestic production, accelerating technological innovation, and diversifying international partnerships.

While these efforts have yielded notable advancements in chip manufacturing and design, structural barriers and external pressures continue to test China’s quest for self-sufficiency.

China’s Semiconductor Ambitions Under “Made in China 2025”

National Policy Framework and Investment Surge

China’s semiconductor strategy is anchored in its “Made in China 2025” initiative, which aims to achieve 70% self-sufficiency in critical technologies, including semiconductors, by 2025.

Despite falling short of this target, the policy has mobilized over $150 billion in state-led investments since 2014, channeled through vehicles like the National Integrated Circuit (IC) Industry Investment Fund (Big Fund) and 15 regional semiconductor funds.

These investments prioritize front-end manufacturing, R&D, and talent development, with subsidies, tax breaks, and discounted land leases incentivizing domestic innovation.

The Big Fund alone has allocated $39 billion, of which 69.7% is directed toward manufacturing infrastructure, while local governments contributed an additional $25 billion.

State-owned enterprises (SOEs) and “national champions” like Semiconductor Manufacturing International Corporation (SMIC) and Huawei Technologies have emerged as primary beneficiaries, receiving billions in grants and low-interest loans.

For instance, in 2022, SMIC secured $1.95 billion in subsidies to expand its 300mm wafer production lines, reflecting the government’s focus on reducing reliance on foreign foundries like TSMC and Samsung.

Challenges in Technological Catch-Up

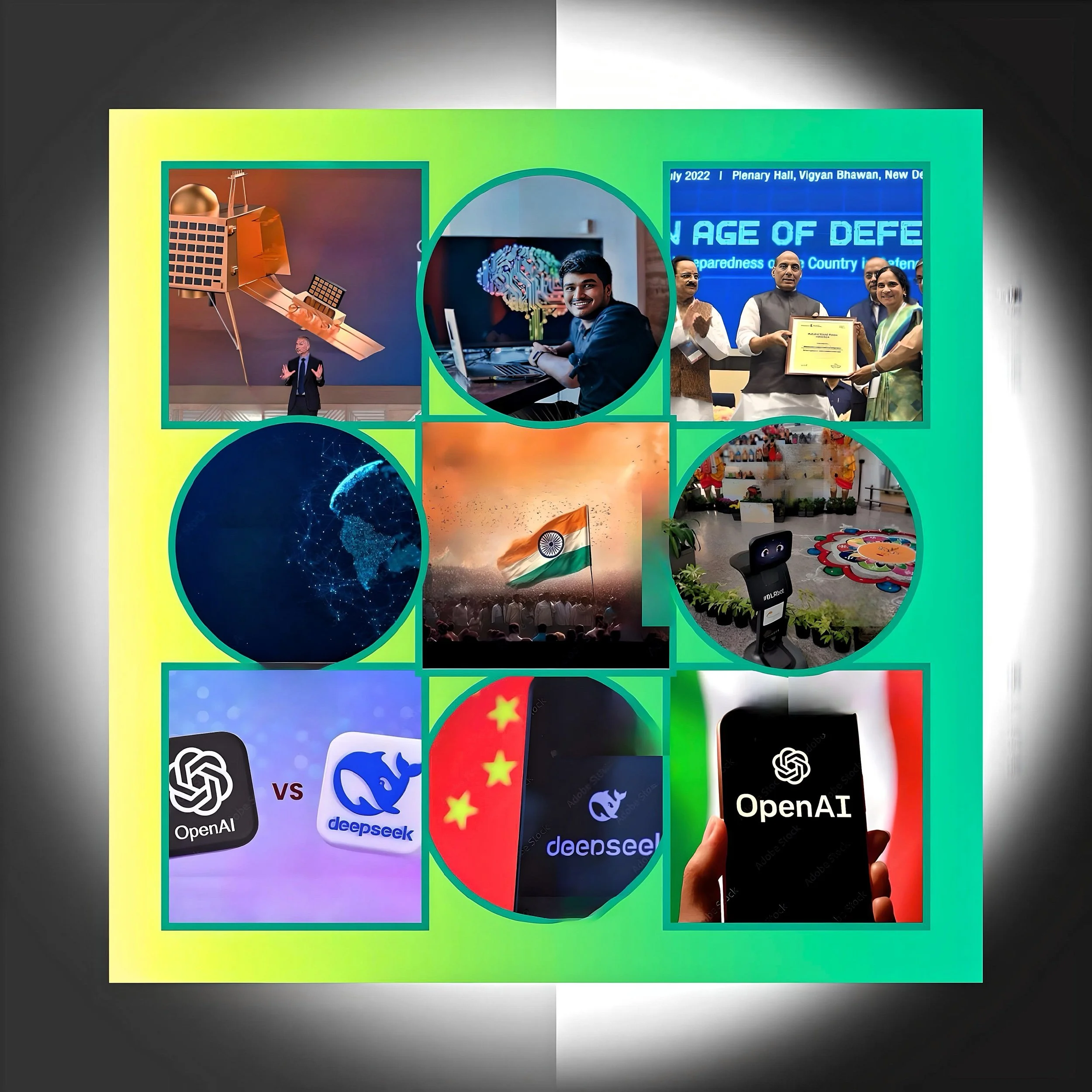

Despite these investments, China’s semiconductor ecosystem lags in advanced logic node production, extreme ultraviolet (EUV) lithography, and electronic design automation (EDA) tools.

U.S. export restrictions on cutting-edge equipment, including ASML’s EUV machines, have forced SMIC to rely on older deep ultraviolet (DUV) lithography systems and innovative patterning techniques like quadruple exposure to produce 7nm and 5nm chips.

While this workaround enabled Huawei’s Kirin 9010 processor for the Mate 60 Pro smartphone, yields remain suboptimal (20–50%) compared to global standards, raising production costs and limiting scalability.

Adapting to U.S. Export Controls and Tariffs

Diversifying Supply Chains and Partnerships

China has pursued strategic collaborations with non-U.S. suppliers in Europe, Japan, and South Korea to mitigate the impact of U.S. sanctions.

For example, SMIC partnered with Dutch firm ASML to procure DUV systems before tightened restrictions took effect, enabling continued production of 7nm chips.

Additionally, Beijing is fostering regional alliances, such as Anhui province’s support for ChangXin Memory Technologies (CXMT) to develop low-power DDR5 DRAM chips, reducing dependence on Samsung and Micron.

Domestically, China is consolidating its semiconductor supply chain by integrating upstream material suppliers, fabrication plants, and downstream consumers.

Huawei’s HiSilicon division collaborates with SMIC to co-design chips for AI and 5G applications. At the same time, state-backed funds subsidize local equipment manufacturers like Advanced Micro-Fabrication Equipment (AMEC) to replace U.S.-made etching tools.

Stockpiling and Overcapacity Concerns

The tariff war has prompted Chinese firms to accelerate orders and stockpile critical components.

SMIC reported a surge in “rush orders” in early 2025 as clients sought to secure inventory ahead of anticipated U.S. tariff hikes.

However, this has exacerbated overcapacity risks, with TechInsights predicting a 6% decline in China’s semiconductor equipment spending in 2025 due to underutilized fabs.

Overreliance on legacy nodes (28nm and above) further compounds inefficiencies as global demand shifts toward advanced AI and edge computing chips.

Innovation and Indigenous R&D Initiatives

Breakthroughs in Advanced Node Development

China’s semiconductor strategy prioritizes indigenous innovation to bypass foreign intellectual property (IP) constraints.

SMIC’s development of 5nm chips using N+2 multi-patterning—a technique requiring four lithography passes per layer—demonstrates progress despite lacking EUV capabilities.

While this approach increases production complexity and costs, it has allowed Huawei to mass-produce Ascend 910C AI chips for data centers, albeit with yields as low as 20%.

State-funded research institutes like the Chinese Academy of Sciences spearhead projects in novel transistor architectures (e.g., gate-all-around FETs) and advanced packaging technologies like chipset integration.

These efforts compensate for process node limitations by enhancing chip performance through heterogeneous design.

Talent Cultivation and Academic Collaboration

China has expanded semiconductor-focused programs at universities like Tsinghua and Peking to address a critical shortage of skilled engineers while offering lucrative incentives for overseas experts to relocate.

Partnerships between academia and industry, such as Huawei’s Qingpu R&D center (employing 35,000 researchers), aim to accelerate IP generation and process optimization.

Geopolitical and Economic Implications

Escalating U.S.-China Tech Rivalry

The U.S. has responded to China’s advancements by expanding its Entity List to include 200 additional Chinese firms, targeting SMIC’s suppliers and Huawei’s fabrication partners.

These measures aim to stifle China’s access to advanced equipment and materials, though analysts note they have inadvertently strengthened Beijing’s resolve to achieve self-reliance.

For instance, Huawei’s $1.4 billion investment in chip R&D in 2024 reflects a strategic pivot toward vertical integration, reducing dependence on foreign EDA tools and IP cores.

Global Market Repercussions

China’s semiconductor push has reshaped global trade dynamics. In 2023, China accounted for 40% of global wafer fab equipment spending ($41 billion), driven by aggressive capacity expansion.

However, overinvestment in mature nodes has flooded markets with legacy chips, pressuring prices and margins for Western competitors like Texas Instruments and STMicroelectronics. Meanwhile, Chinese exports of semiconductor devices grew to $49.2 billion in 2023, with India, the Netherlands, and Hong Kong emerging as key markets.

Conclusion: Balancing Progress and Peril

China’s semiconductor strategy underscores a paradoxical reality: while state support has enabled chip design and manufacturing breakthroughs, structural dependencies on foreign technology persist.

The lack of EUV lithography capabilities, low production yields, and geopolitical headwinds pose significant hurdles to achieving true self-sufficiency.

Nevertheless, Beijing’s $47 billion investment fund and a relentless focus on R&D positions China to narrow the gap with global leaders in niche domains like AI chips and DRAM.

Looking ahead, the success of China’s semiconductor ambitions hinges on three factors:

(1) mastering advanced lithography through clandestine acquisitions or breakthroughs in domestic EUV development

(2) improving yields and cost efficiency to compete commercially

(3) navigating an increasingly fragmented global supply chain.

As the U.S. and China entrench their positions, this high-stakes contest for technological supremacy will shape the semiconductor industry's future.