China’s Economic Trajectory to 2050: Projections and Strategic Initiatives

Introduction

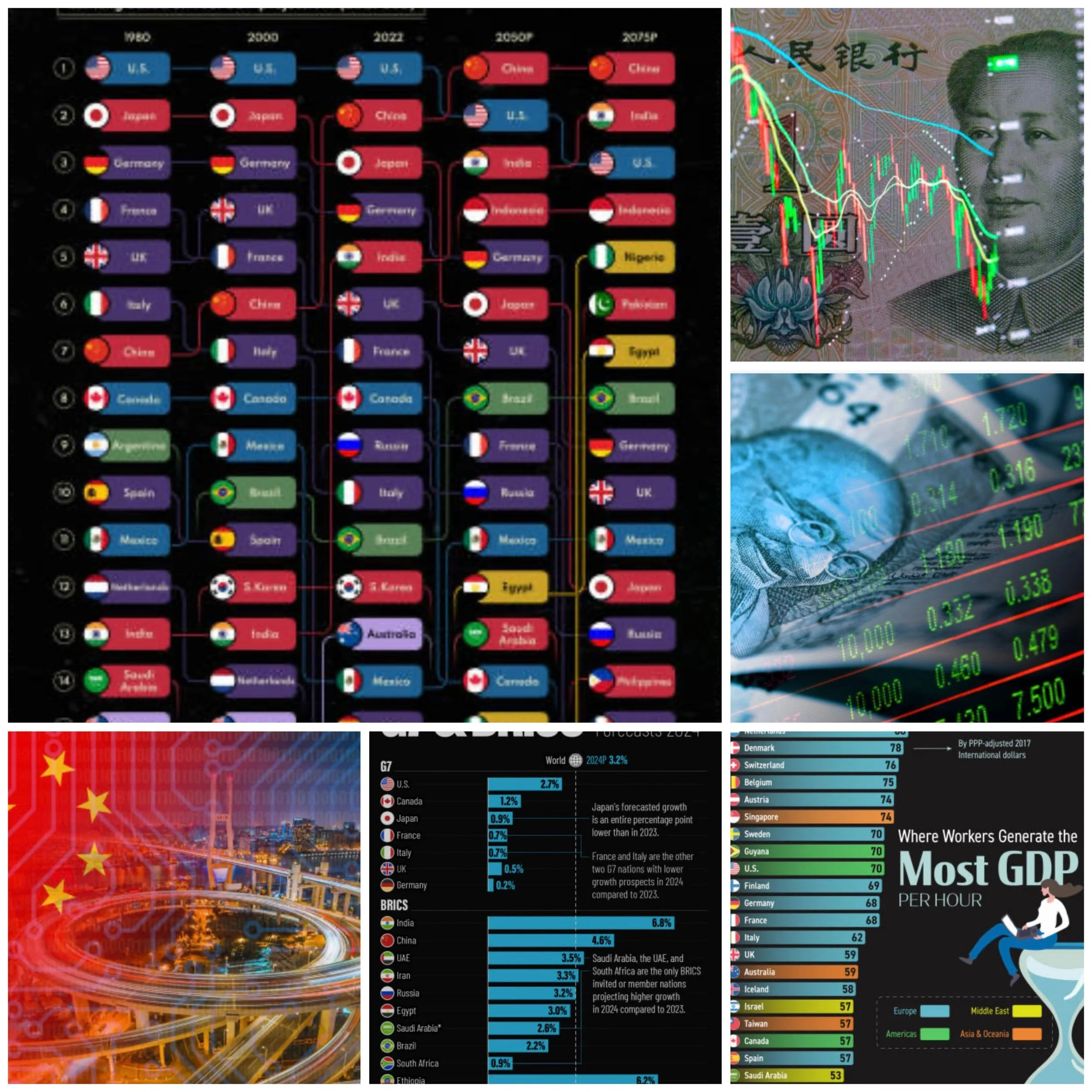

China’s economic future remains a subject of intense global scrutiny, with projections for its 2050 GDP ranging from $35 trillion to $45 trillion in real terms, depending on demographic trends, policy effectiveness, and technological advancements.

While the nation is poised to solidify its status as the world’s largest economy, growth rates are expected to decelerate sharply, averaging 2–3% annually by the 2040s due to aging populations, diminishing returns on capital-intensive investments, and productivity challenges.

Concurrently, China is pursuing an ambitious dual strategy: transitioning to a zero-carbon economy while restructuring its growth model to prioritize innovation, domestic consumption, and circular resource use.

This article reviews these dynamics in detail, analyzing the interplay of structural constraints and transformative policies shaping China’s mid-century outlook.

Demographic Decline and Its Economic Implications

The Aging Population Crisis

China’s working-age population, which expanded by 1.7% annually from 1980 to 2010, is projected to contract by 0.9% yearly through 2050 due to the lingering effects of the one-child policy and rising life expectancy.

By 2040, over 30% of citizens will be aged 60 or older, straining pension systems and healthcare infrastructure while reducing labor force participation.

This demographic shift could erase 0.5–1.0 percentage points from annual GDP growth, compounding the drag from already declining total factor productivity.

Urbanization Slowdown and Labor Market Saturation

With urbanization rates plateauing near 75% by 2040—compared to 64% in 2022—China can no longer rely on rural-to-urban migration to boost productivity.

The saturation of low-cost manufacturing employment has forced a pivot toward high-skilled sectors, but workforce retraining programs lag behind technological needs.

State-led initiatives like the “Common Prosperity” campaign aim to redistribute wealth and stabilize domestic consumption, yet these measures risk stifling private sector innovation if implemented heavy-handedly.

The Decarbonization Imperative

Electrification and Renewable Energy Expansion

To achieve net-zero emissions by 2050, China plans to triple electricity generation to 15,000 TWh annually, with renewables comprising 85% of the mix.

Solar and wind capacity must expand eightfold to 5,500 GW by mid-century, requiring $12 trillion in grid modernization, storage infrastructure, and smart distribution networks.

Current investments exceed $140 billion yearly in renewables alone, though coal phaseout timelines remain ambiguous.

Hydrogen Economy and Industrial Decarbonization

The government’s 2021–2035 hydrogen roadmap targets 200,000 hydrogen refueling stations and 30% penetration of hydrogen in heavy transport by 2050.

Steel and cement production—responsible for 15% of national emissions—will transition to hydrogen-based direct reduction and carbon capture systems, aiming for 60% recycled steel output by 2040.

Pilot projects like Baowu Steel’s hydrogen-powered furnace (2023) demonstrate technical feasibility, but scalability depends on lowering green hydrogen costs below $1.50/kg.

Technological Leadership and Innovation Drive

Semiconductor Self-Sufficiency

Facing U.S. export controls, China allocated $143 billion in 2023–2027 subsidies to domestic chip fabrication, targeting 70% self-reliance in advanced nodes (<7nm) by 2030.

SMIC’s 5nm process breakthrough (2024) and Huawei’s Kirin 9010 AI chips exemplify progress, though yields lag TSMC’s by 30–40%.

The “Little Giant” program nurtures 10,000 specialized SMEs in robotics, quantum computing, and biotech, leveraging $47 billion in state-guided venture capital.

AI and Digital Infrastructure Dominance

China’s 2022 AI Development Plan prioritizes global leadership in generative AI, with Baidu’s Ernie 4.0 and Alibaba’s Tongyi Qianwen 2.0 rivaling GPT-4 capabilities.

Surveillance networks integrating 600 million CCTV cameras and 1.4 billion digital IDs enable data-driven urban management, but also concentrate technical talent in state-approved projects.

Annual AI R&D spending surpassed $15 billion in 2024, fostering applications from precision agriculture to predictive maintenance in manufacturing.

Structural Economic Rebalancing

From Export-Led to Domestic Consumption

Household consumption, stagnant at 38% of GDP since 2010, is targeted to reach 50% by 2040 through tax reforms and social safety net expansions.

The 2025 Dual Circulation Strategy emphasizes supply chain resilience via “Made in China 2025” upgrades, reducing intermediate goods imports from 35% to 20% of total inputs.

E-commerce platforms like Pinduoduo and Douyin now drive 45% of retail sales, enabling broader consumer market penetration.

Debt Management and Financial System Overhaul

With corporate debt at 160% of GDP and local government financing vehicles holding $9 trillion in liabilities, regulators are implementing debt-for-equity swaps and municipal bond markets to mitigate systemic risks.

The 2023 Central Financial Work Conference introduced stricter shadow banking controls, aiming to cap overall leverage at 300% of GDP by 2025.

These measures seek to redirect capital from speculative real estate (down from 29% to 19% of GDP since 2021) toward strategic industries.

Geoeconomic Positioning and Trade Realignment

Belt and Road Initiative 2.0

Post-2025 BRI focus shifts from infrastructure loans to digital and green technology exports, with 60% of $1.3 trillion in planned investments allocated to smart grids, EV supply chains, and 5G networks.

Digital BRI agreements with ASEAN nations aim to establish China-centered data governance standards, countering U.S.-EU data flow frameworks.

Regional Comprehensive Economic Partnership (RCEP) Integration

As RCEP’s linchpin, China leverages tariff eliminations on 90% of goods to anchor Asian supply chains, capturing 35% of regional semiconductor trade by 2030.

Yuan internationalization advances through $500 billion in bilateral swap lines and digital yuan adoption across 23 countries, though dollar dominance persists at 59% of global reserves.

Conclusion

A Contested Ascent

China’s path to 2050 GDP of $35–45 trillion hinges on executing parallel transitions—demographic adaptation, carbon neutrality, and technological self-reliance—amid intensifying geopolitical friction.

While state-capacity advantages in infrastructure deployment and R&D coordination provide unique leverage, structural rigidities in capital allocation and innovation ecosystems pose enduring risks.

Success requires balancing authoritarian efficiency with market dynamism, a paradigm yet to be proven at China’s scale.

The world must prepare for a China that is economically preeminent yet internally challenged, wielding transformative green technologies while navigating the paradoxes of its development model.