China’s Economic Trajectory and the Prospects of Surpassing US GDP by 2050

Introduction

China’s potential to overtake the United States as the world’s largest economy by 2050 has been a subject of intense debate among economists, policymakers, and global institutions.

While projections vary widely based on methodologies and assumptions, structural trends in demographics, technological innovation, and industrial policy will play decisive roles in shaping the outcome.

FAF article synthesizes current economic forecasts, analyzes key growth sectors, and evaluates challenges that could alter China’s path to global economic leadership.

Current Economic Landscape and Baseline Projections

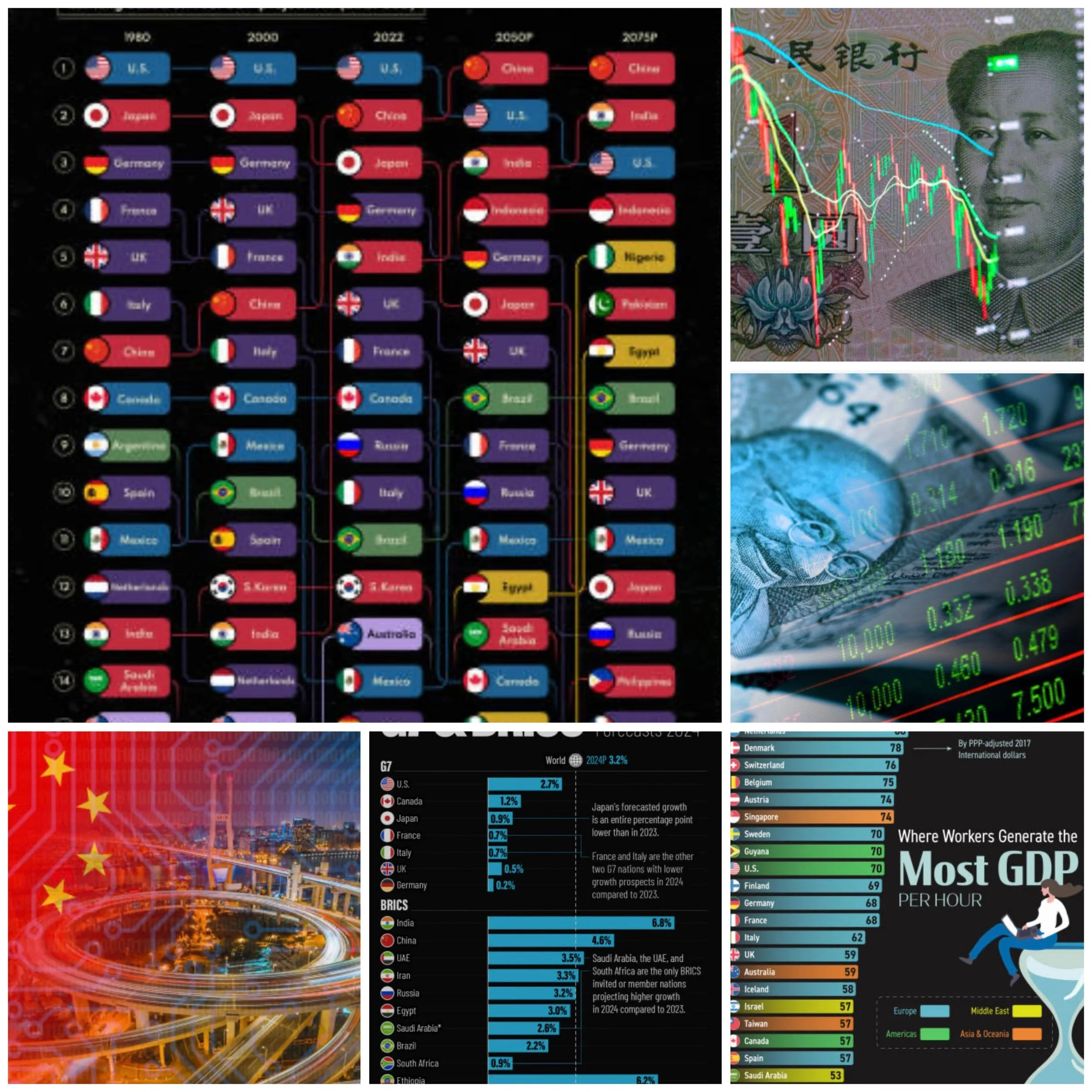

Global GDP Rankings and Historical Context

As of 2025, the United States remains the world’s largest economy, with a nominal GDP of approximately $28 trillion, followed by China at $18.5 trillion.

However, measured by purchasing power parity (PPP), China surpassed the U.S. in 2017, highlighting its immense domestic consumption base.

Over the past three decades, China’s average annual GDP growth of 8–10% has been fueled by export-led manufacturing, urbanization, and state-driven investment.

By contrast, U.S. growth has averaged 2–3%, sustained by technological innovation and a dynamic services sector.

Diverging Long-Term Forecasts

Economic models project starkly different outcomes for China and the U.S. by mid-century

Optimistic Projections

The Carnegie Endowment (2009) predicted China’s economy would grow to $45.6 trillion by 2050, 20% larger than the U.S. ($38 trillion) in real terms.

John Thornton, former Goldman Sachs co-president, forecasted China’s GDP at $42 trillion versus $38 trillion for the U.S., driven by sustained industrialization and demographic momentum.

Goldman Sachs (2022) reiterated China’s lead by 2050, with India, Indonesia, and Germany trailing.

Skeptical Views

Capital Economics argues structural headwinds—declining productivity, debt overhang, and demographic decline—will prevent China from overtaking the U.S. on a sustained basis.

The IMF projects China’s growth slowing to 3% by 2029, narrowing its lead over a resilient U.S. economy.

Demographic models suggest China’s working-age population will shrink by 18% by 2050, eroding labor-intensive advantages.

Middle-Ground Scenarios

The Lowy Institute estimates China’s annual GDP growth at 2–5% through 2050, contingent on reforms to boost productivity and consumption.

The U.S. Congressional Budget Office (CBO) forecasts 1.6% annual growth for the U.S., with real GDP per capita rising modestly despite aging demographics.

Key Drivers of China’s Economic Ascent

Technological Innovation and Digital Economy

China’s push to become a “science and technology superpower” by 2050 underpins its growth strategy. Key initiatives include

Artificial Intelligence (AI)

State-backed investments in facial recognition, autonomous vehicles, and smart cities aim to position China as the global AI leader by 2030.

Companies like Huawei and Alibaba are developing AI chips to reduce reliance on foreign semiconductors.

Semiconductor Independence

Despite U.S. export controls, China’s semiconductor industry is projected to achieve 70% self-sufficiency by 2030, bolstering sectors from consumer electronics to defense.

Green Technology

China dominates solar panel (80% global production) and electric vehicle (60% of worldwide sales) markets, aligning with its 2060 carbon neutrality pledge.

Innovations in battery storage and hydrogen energy could further consolidate its clean-tech leadership.

Manufacturing and Industrial Policy

China’s “Dual Circulation” strategy emphasizes upgrading manufacturing through automation and smart factories.

The “Made in China 2025” plan targets self-sufficiency in robotics, aerospace, and biomedical devices, with the goal of increasing high-tech manufacturing’s GDP share to 25% by 2035.

State-owned enterprises (SOEs) and private giants like BYD and CATL are central to this transformation.

Nuclear Fusion

China is in process of building lastest Nuclear Fusion plant to be ready by 2035. Many nations are behind.

Demographic and Urbanization Dynamics

While China faces a shrinking workforce, urbanization remains a growth lever.

By 2050, 80% of China’s population will reside in cities, compared to 65% in 2025, driving demand for infrastructure, real estate, and services.

Mega-regions like the Greater Bay Area (population: 86 million) are becoming hubs for finance and innovation.

Geopolitical and Institutional Factors

China’s centralized governance enables rapid execution of long-term projects, such as the Belt and Road Initiative (BRI), which expands its economic influence across Asia and Africa.

By contrast, U.S. growth relies on private-sector dynamism, though political polarization and fiscal deficits pose risks.

Structural Challenges and Risks

Demographic Decline

China’s population peaked at 1.4 billion in 2021 and is projected to fall to 1.3 billion by 2050, with the elderly (65+) comprising 30% of the population.

This will strain pension systems and healthcare, diverting resources from productive investments.

Debt and Financial Stability

Corporate debt exceeds 160% of GDP, with local governments and SOEs accumulating $8 trillion in hidden liabilities. A property sector crisis—exemplified by Evergrande’s default—threatens to destabilize banks and consumer confidence.

Technological Decoupling

U.S. restrictions on advanced chip exports and investment in Chinese tech firms could delay breakthroughs in AI and quantum computing.

China’s R&D spending ($526 billion in 2023) trails the U.S. ($806 billion), but its focus on applied research narrows the gap.

Environmental Constraints

China’s coal-dependent energy mix (60% of electricity) complicates decarbonization efforts.

Transitioning to renewables requires $17 trillion in investments by 2050, risking short-term growth for long-term sustainability.

Comparative Analysis: U.S. Resilience and Innovation

The U.S. benefits from a demographic edge, with immigration offsetting aging trends and a fertility rate (1.7) above China’s (1.2).

Silicon Valley’s dominance in AI, cloud computing, and biotechnology—supported by venture capital and university research—ensures continued leadership in high-value sectors.

The Inflation Reduction Act (IRA) and CHIPS Act are funneling $500 billion into clean energy and semiconductor manufacturing, countering China’s state-led model.

Conclusion

A Bifurcated Economic Future

By 2050, China’s GDP is likely to rival or modestly exceed that of the U.S., but per capita income will remain 40–50% lower, reflecting persistent productivity gaps.

Success hinges on transitioning to consumption-driven growth, reforming SOEs, and navigating U.S.-China tech rivalry.

For the U.S., maintaining innovation ecosystems and fiscal discipline will be critical to retaining economic primacy.

Ultimately, the 21st century’s economic landscape may be defined not by a single hegemon, but by competing models of development—China’s state-capitalist system versus America’s market-driven dynamism—with profound implications for global governance and trade.