Will China Leave India and the US in the Dust by 2050? Exploring Future Economic Growth

Introduction

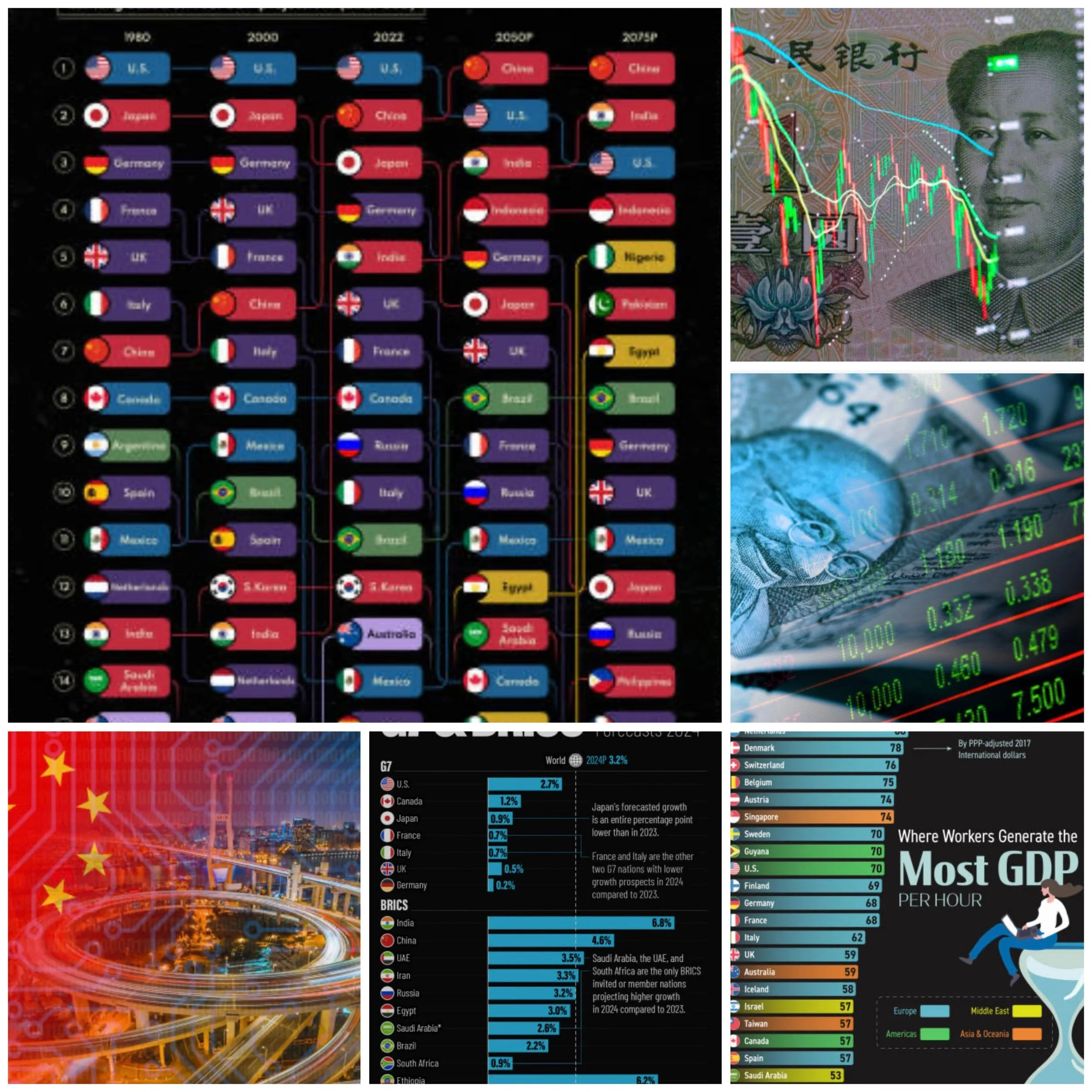

In recent decades, China's economic rise has captivated the world, piquing the interest of economists, business leaders, and investors alike. But what does the future hold for this economic powerhouse? More specifically, how will China's growth compare with that of India and the United States by 2050? This blog post takes an in-depth look at China's economic trajectory, examining key projects and GDP growth forecasts to offer valuable insights for those who seek to understand the shifting tides of global economic power.

The Rise of a Dragon Economy

China's rapid transformation from an agrarian society to an economic juggernaut is nothing short of remarkable. Since opening its doors to the global market in the late 20th century, China has consistently posted impressive GDP growth rates. Between 1980 and 2015, the country's GDP grew at an average annual rate of about 10%. This meteoric rise has been fueled by major reforms, foreign investments, and burgeoning export industries.

China's ongoing economic expansion is a topic of great interest for economic analysts who keep a close eye on global market trends. For business leaders, understanding China's growth can guide strategic decisions, while investors seek to capitalize on opportunities in one of the world's largest markets. With these stakeholders in mind, this blog post will explore the forces driving China's economic future and consider its implications on a global scale.

China's Ambitious Projects for Sustained Growth

China's economic might is not just a result of past successes; it is also built on ambitious plans for the future. The country's government has laid out a series of projects designed to ensure continued growth and development, focusing on innovation, infrastructure, and international cooperation.

One of the most well-known initiatives is the Belt and Road Initiative (BRI), a massive infrastructure project aimed at connecting Asia with Africa and Europe through land and maritime networks. By investing in roads, railways, ports, and energy projects across more than 60 countries, China aims to boost trade and economic integration on a global scale. The BRI is estimated to cost over $1 trillion and is expected to yield substantial economic benefits for China and its partners.

Additionally, China has made significant investments in technology and innovation through its "Made in China 2025" strategy. This plan aims to upgrade Chinese industries and move them up the value chain by focusing on advanced manufacturing sectors like robotics, aerospace, and biotechnology. By fostering homegrown innovation, China seeks to become a global leader in high-tech industries, further solidifying its economic prowess.

GDP Growth Projections for China

With its strategic projects in place, China's economic forecasts remain optimistic. According to the World Bank and International Monetary Fund, China's GDP is expected to continue growing at a healthy pace, albeit at a slower rate than in previous decades. By 2050, China's GDP is projected to reach approximately $58.5 trillion, potentially surpassing that of the United States and India.

However, it's important to note that these projections are subject to various uncertainties, such as demographic shifts, geopolitical tensions, and potential policy changes. Nonetheless, China's track record of sustained growth and ambitious development plans suggest that the country is well-positioned to remain a global economic powerhouse in the coming decades.

Comparing China's Growth with India's Economic Prospects

While China has been the subject of much economic analysis, India's growth trajectory is also worth examining. Like China, India has seen significant economic growth in recent years, driven by a young population, rapid urbanization, and economic reforms. The Indian economy has averaged an impressive growth rate of 6-7% annually over the past couple of decades.

By 2050, India's GDP is projected to reach around $44 trillion, making it the world's third-largest economy after China and the United States. However, India faces its own set of challenges, including income inequality, infrastructure deficits, and regulatory hurdles. Despite these challenges, India's large workforce and growing middle class present significant opportunities for continued growth.

China's Economic Strategies Versus India's Growth Model

China and India have adopted different approaches to economic development, each with its own set of strengths and weaknesses. China's growth model has been characterized by state-led capitalism, with significant government intervention in key industries and strategic sectors. This approach has allowed China to rapidly expand its infrastructure and industrial base, but it has also led to concerns about rising debt levels and imbalances in the economy.

In contrast, India's growth model has been more market-oriented, with a focus on private enterprise and entrepreneurship. While this approach has fostered innovation and competition, it has also resulted in uneven development and challenges in scaling infrastructure and public services.

Both countries face the challenge of transitioning to more sustainable growth models that balance economic development with social and environmental considerations. For economic analysts and business leaders, understanding these nuances is crucial for assessing the long-term prospects of both economies.

The United States in the Race for Economic Supremacy

While China and India are often discussed in the context of emerging markets, the United States remains a formidable economic force. With a mature and diversified economy, the US continues to lead in areas such as technology, finance, and healthcare. Its GDP is projected to reach approximately $49.1 trillion by 2050, making it the second-largest economy after China.

The US's competitive advantage lies in its strong institutions, innovative culture, and access to capital. However, it also faces challenges such as rising inequality, political polarization, and the need for infrastructure modernization. For business leaders and investors, understanding the interplay between these factors is essential for making informed decisions in a rapidly changing global landscape.

Comparing China's GDP Growth to the United States

When comparing China's GDP growth to that of the United States, it's important to consider both countries' unique contexts. While China's rapid growth has been driven by its transition from a planned economy to a market-oriented one, the US's growth has been more stable and consistent over time.

China's GDP growth rate is expected to slow as it matures and faces challenges such as an aging population and environmental concerns. In contrast, the US's growth rate is projected to remain relatively stable, supported by technological innovation and a robust service sector.

Despite these differences, both countries are expected to maintain significant roles in the global economy, with China potentially surpassing the US in terms of GDP size. For economic analysts, understanding the dynamics between these two powerhouses is crucial for forecasting future trends and opportunities.

Implications of China's Economic Growth for Global Trade

China's continued economic growth will have far-reaching implications for global trade and investment. As the country's economy expands, its demand for goods and services will increase, creating opportunities for businesses worldwide. Additionally, China's investments in infrastructure and technology will facilitate greater connectivity and integration in global markets.

However, China's economic rise also presents challenges, particularly in terms of trade relations and competition. The US-China trade tensions of recent years have highlighted the complexities of navigating economic interdependence in a multipolar world. For business leaders and investors, understanding the evolving landscape of global trade is essential for identifying opportunities and mitigating risks.

The Role of Innovation in China's Economic Future

Innovation will play a critical role in shaping China's economic future. The country's emphasis on research and development, coupled with its investments in high-tech industries, positions it as a leader in the global innovation race. China's progress in areas such as artificial intelligence, renewable energy, and biotechnology will not only drive domestic growth but also influence global markets.

For economic analysts and business leaders, China's focus on innovation offers valuable insights into emerging trends and opportunities. By staying abreast of China's technological advancements, stakeholders can better anticipate shifts in the competitive landscape and align their strategies accordingly.

Investing in China's Economic Growth

Investing in China's economic growth presents both opportunities and challenges. On one hand, China's large and growing market offers significant potential for returns. On the other hand, navigating the complexities of China's regulatory environment and political landscape requires careful consideration.

For investors, understanding the key sectors driving China's growth is crucial. Industries such as consumer goods, technology, and renewable energy offer promising opportunities, while sectors impacted by government regulation may pose risks. By conducting thorough research and due diligence, investors can make informed decisions and capitalize on China's economic ascent.

China, India, and the United States by 2050

By 2050, the global economic landscape is expected to look markedly different from today. China is projected to lead the world in GDP size, followed by the United States and India. Each of these countries will play a pivotal role in shaping the global economy, with unique strengths and challenges that will influence their trajectories.

For economic analysts, business leaders, and investors, understanding the interplay between these three giants is essential for making strategic decisions. By staying informed about key trends and developments in China, India, and the US, stakeholders can position themselves to thrive in a rapidly evolving world.

Conclusion

China's economic growth by 2050 is a topic of great interest and significance for economic analysts, business leaders, and investors. While the country faces challenges, its ambitious projects, innovative strategies, and robust GDP growth projections suggest a promising future. By understanding China's economic trajectory and its implications for global markets, stakeholders can make informed decisions and seize opportunities in a dynamic and interconnected world.