European Defense Autonomy and Its Implications for Global Power Dynamics The emergence of a more autonomous European

Introduction

The emergence of a more autonomous European defense architecture, driven by geopolitical necessity and institutional ambition, is poised to reshape the global balance of power.

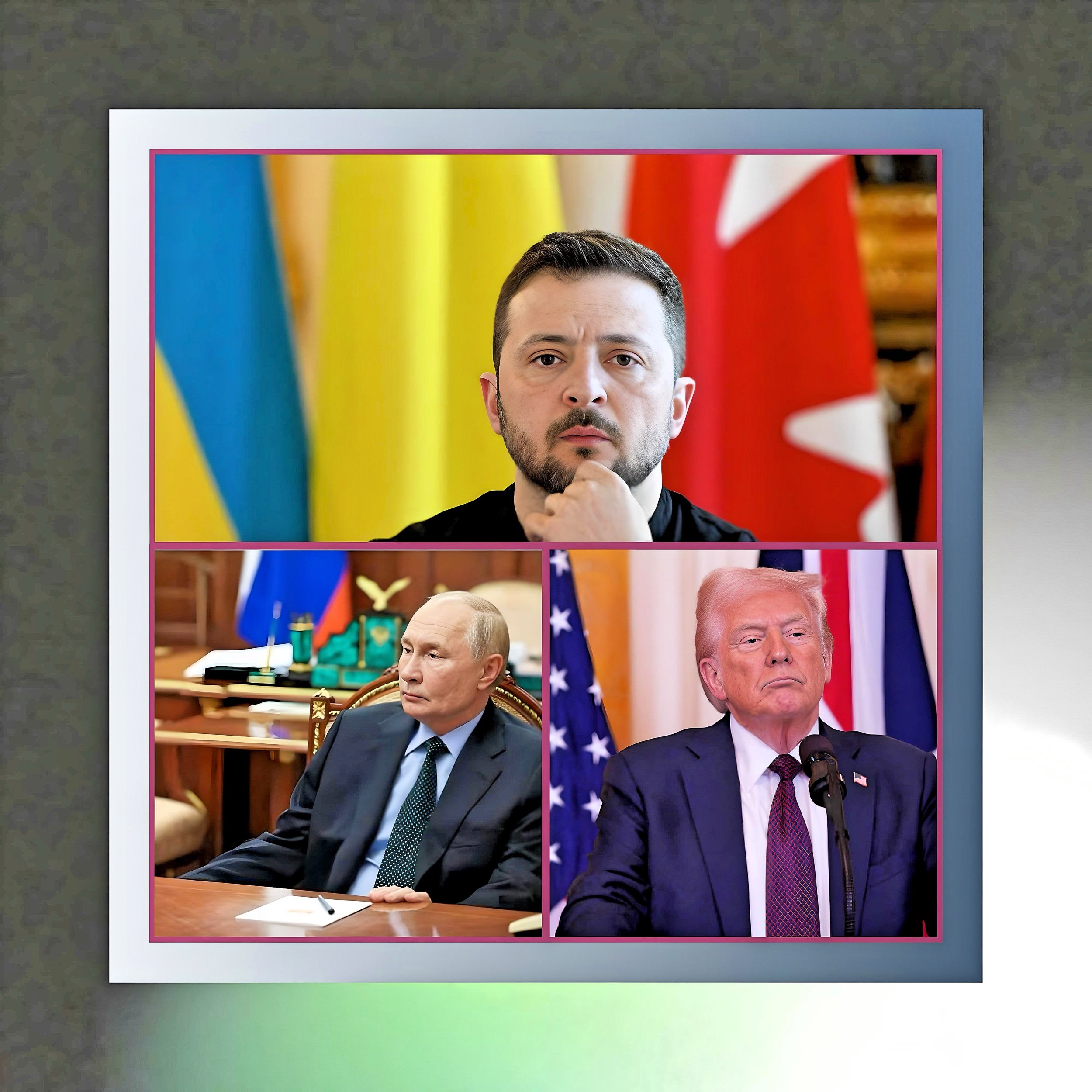

This shift—accelerated by U.S. strategic recalibration under President Trump and the exigencies of Russia’s war in Ukraine—carries implications for transatlantic relations, regional security frameworks, and the structure of international alliances.

Below, we analyze how Europe’s pursuit of strategic autonomy could reconfigure global power dynamics across military, economic, and diplomatic domains.

Transatlantic Relations

From Dependency to Competitive Partnership

Redefining NATO’s Role

A militarily self-sufficient Europe would fundamentally alter NATO’s operational and political dynamics.

While the alliance remains anchored by Article 5 commitments, Europe’s growing capacity to independently address regional threats—such as through its proposed 5,000-strong EU Rapid Deployment Force—could reduce reliance on U.S. assets like aerial refueling tankers and satellite intelligence.

This shift may allow the U.S. to reallocate resources to Indo-Pacific priorities, but it risks creating redundancies. For instance, NATO’s Response Force and the EU’s new rapid reaction unit both target similar crisis scenarios, potentially diluting coordination efforts.

Economic Decoupling in Defense Markets

Europe’s push to source 50% of defense equipment intra-EU by 2030 under the European Defence Industrial Strategy (EDIS) threatens U.S. dominance in arms exports.

In 2024, 60% of Europe’s defense imports came from the U.S., including critical systems like F-35 jets and Patriot missiles.

A pivot toward homegrown platforms—such as the Franco-German Future Combat Air System (FCAS)—could erode U.S. market share, incentivizing American firms to deepen ties with Asian partners like Japan and South Korea.

However, collaboration in emerging technologies (e.g., AI-driven battlefield systems) may emerge as a stabilizing factor, preserving transatlantic interoperability.

Multipolarity and the Reshaping of Global Alliances

Europe as a Third Strategic Pole

With defense spending projected to reach 3.5% of EU GDP by 2029 (up from 1.9% in 2024), Europe is positioning itself as a counterweight to both U.S. and Chinese influence. This trajectory enables:

Balancing Acts in the Indo-Pacific

The EU-India Free Trade Agreement (FTA), finalized in March 2025, includes defense technology transfers, allowing Europe to challenge China’s regional hegemony without directly aligning with U.S. containment strategies.

Leverage in the Global South

By revising the stalled Mercosur trade pact with sustainability-linked investment clauses, Europe gains diplomatic capital in Latin America, countering Chinese infrastructure diplomacy under the Belt and Road Initiative.

Strain on U.S.-Led Sanctions Regimes

Europe’s autonomous sanctions mechanisms—such as its blockchain-tracked diamond embargo targeting Russia’s Alrosa—demonstrate a willingness to act independently of U.S. Treasury directives.

This could fragment Western economic coercion efforts, particularly if EU exemptions for strategic partners (e.g., Hungary’s energy deals with Russia) create enforcement loopholes.

Regional Security Implications

Containment of Russian Aggression

Europe’s €50 billion Ukraine Facility and bilateral security guarantees from France and Germany provide a sustainable counter to Russian revanchism, even amid U.S. aid suspensions.

With EU artillery shell production set to hit 1 million annually by 2026, Ukraine can maintain pressure on Russian forces, preventing Moscow from redirecting resources to other theaters like the Caucasus or Balkans.

However, Europe’s lack of strategic nuclear parity with Russia (relying on French and British arsenals) leaves lingering deterrence gaps.

Stabilization of the African Sahel

The EU’s proposed Joint Intelligence Cell, pooling signals intelligence from France’s DGSE and Germany’s BND, enhances counterterrorism capabilities in Mali and Niger.

Autonomous European operations could fill the void left by departing U.S. drones and special forces, but competing priorities between Mediterranean states (focused on migration) and former colonial powers (prioritizing counterinsurgency) risk operational fragmentation.

Economic and Industrial Shifts

Defense Industry Consolidation

The European Defence Fund’s $150 billion budget for joint R&D is catalyzing cross-border mergers, such as the tie-up between Italy’s Leonardo and Spain’s Indra for drone development.

This consolidation positions EU firms to compete globally: Rheinmetall’s Lynx armored vehicle, for example, is now outselling U.S. rivals in Southeast Asia. However, overreliance on EU subsidies risks creating “national champions” ill-equipped for commercial competition.

Energy Security Rebalancing

Europe’s Mediterranean Solar Initiative (transmitting 5 GW of Tunisian solar power via undersea cables) and expanded Azeri gas imports reduce vulnerability to U.S. LNG export volatility.

This diversification weakens Russia’s energy leverage but strains relations with Gulf monarchies, which had positioned themselves as alternative suppliers.

Institutional Challenges and Internal Cohesion

Sovereignty Versus Integration Tensions

While the EU’s adoption of Qualified Majority Voting (QMV) for sanctions overrides Hungarian vetoes, resistance persists.

Poland’s unilateral $14 billion purchase of South Korean FA-50 fighters—circumventing EU procurement guidelines—highlights enduring sovereignty disputes. Without harmonization, redundant systems could consume 20% of defense budgets, per the European Defence Agency.

Populist Backlash Risks

Proposals to increase defense spending to 3.5% of GDP by 2030 require reallocating €250 billion annually from social programs, fueling far-right narratives in Italy and Sweden. Simultaneously, Trump’s outreach to Viktor Orbán for bilateral energy deals exploits these fissures, mirroring 2022’s schisms over Russian oil embargoes.

Conclusion

A Fragmented Path to Influence

Europe’s defense autonomy does not herald a straightforward transition to multipolarity but rather a contested reordering of global power structures. Key implications include:

Strategic Decoupling

Reduced U.S. military presence in Europe could accelerate America’s Indo-Pacific pivot, forcing China to contend with two distinct Western power centers rather than a monolithic bloc.

Asymmetric Interdependence

Europe will likely maintain niche dependencies on U.S. space-based infrastructure (e.g., GPS) while asserting autonomy in terrestrial warfare systems, creating complex mutual vulnerabilities.

Institutional Innovation

The EU’s experimental governance models—from blockchain sanctions enforcement to QMV expansion—offer templates for middle powers seeking agency in a bifurcated world.

The ultimate impact hinges on Europe’s ability to reconcile internal divisions while navigating Great Power competition.

Success would position the EU as a regulatory superpower shaping 21st-century conflict norms; failure risks relegating it to geopolitical irrelevance amid U.S.-China rivalry.

As defense budgets swell and old alliances adapt, Europe’s choices will determine whether autonomy fosters stability or exacerbates global fragmentation.