Strategic Realignment: Analyzing Merz’s Push for European Defense Autonomy and Its Implications

Introduction

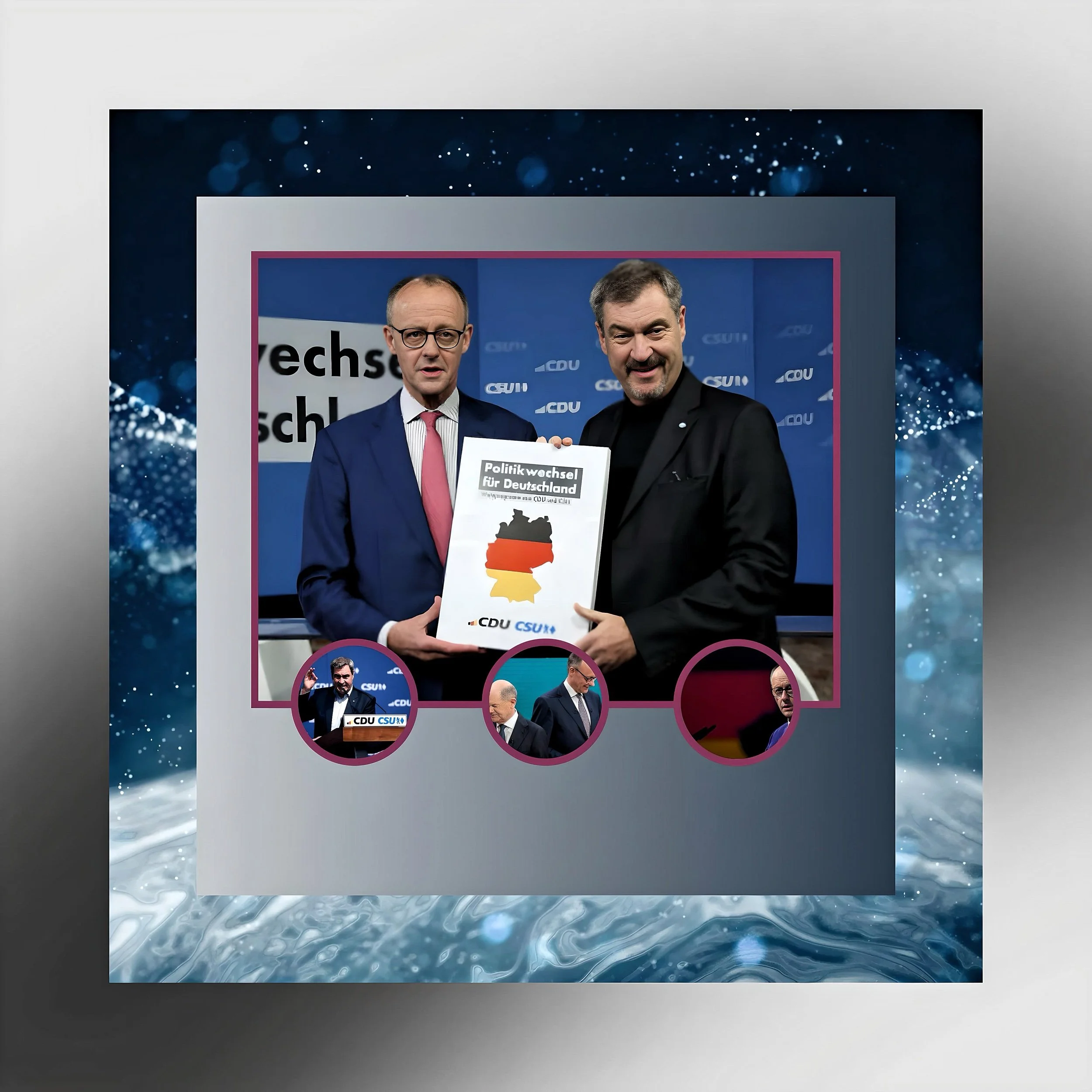

Friedrich Merz’s electoral victory in Germany’s 2025 federal elections marks a pivotal moment in European geopolitics.

As the leader of the CDU/CSU bloc and the presumptive chancellor, Merz has articulated a vision of European defense independence that challenges eight decades of transatlantic security architecture.

His statements reflect growing anxieties over U.S. disengagement under President Donald Trump and signal a reorientation toward EU-centric security frameworks.

This article examines the motivations, implications, and challenges of Merz’s strategy for Germany and the European Union.

The Merz Doctrine: Core Principles and Motivations

Critique of U.S. Disengagement

Merz’s remarks follow Trump’s recent exclusion of European leaders from U.S.-Russia peace talks on Ukraine and his demands for NATO allies to “take charge of their own security”.

Merz argues that Trump’s transactional approach—exemplified by comments like “the Americans are largely indifferent to the fate of Europe”—has rendered traditional reliance on U.S. guarantees untenable.

This aligns with broader European fears that Trump’s potential withdrawal from NATO’s Article 5 mutual defense clause could leave the continent vulnerable to Russian aggression.

Urgency for European Defense Integration

Merz has called for an “independent European defense capability” to be operationalized “much more quickly” than previously envisioned, potentially replacing NATO in its current form. His proposals include:

Joint procurement of military equipment from EU member states to reduce dependency on U.S. suppliers.

Common EU defense bonds to fund modernization, marking a departure from Germany’s traditional opposition to shared EU debt.

Nuclear cooperation with France and the UK, including discussions on extending their nuclear umbrellas to cover Germany.

Economic and Energy Leverage

Merz advocates for EU-U.S. energy deals, such as increased LNG purchases, to “establish constructive relations” with Trump while reducing reliance on Russian gas.

This dual strategy seeks to balance economic pragmatism with strategic autonomy.

Implications for Germany

Domestic Political Shifts

Merz’s defense agenda faces challenges within Germany’s likely coalition government.

The Greens, potential coalition partners, oppose his call for Taurus missile deliveries to Ukraine and may resist defense spending increases at the expense of climate initiatives.

However, acting Economy Minister Robert Habeck (Greens) has acknowledged the “historically unprecedented” need for European self-reliance, suggesting room for compromise.

Military Modernization

Germany’s armed forces (Bundeswehr), long underfunded, could see accelerated reforms under Merz. His government may:

Raise defense spending beyond NATO’s 2% GDP target, potentially reaching 3% by 2030.

Revive projects like the Future Combat Air System (FCAS) with France and Spain.

Relax arms export restrictions to strengthen Europe’s defense industrial base.

Nuclear Policy Reversal

Merz’s openness to nuclear deterrence talks with France and the UK overturns decades of German anti-nuclear orthodoxy. This could lead to:

Joint financing of France’s nuclear arsenal in exchange for extended deterrence guarantees.

Pressure on the UK to clarify its post-Brexit nuclear commitments to Europe.

Implications for the European Union

Accelerated Defense Integration

Merz’s stance aligns with French President Emmanuel Macron’s vision of “European strategic autonomy” but adds urgency due to U.S. unpredictability. Key initiatives could include:

Permanent Structured Cooperation (PESCO) projects focused on cyber defense and missile systems.

A European Rapid Deployment Force of 50,000 troops by 2030.

Centralized EU arms procurement agencies to compete with U.S. contractors.

NATO’s Uncertain Future

While Merz insists NATO remains “important,” he questions whether it will survive in its “current form” beyond the June 2025 summit. Potential outcomes include:

A bifurcated NATO where Europe assumes primary responsibility for continental defense, with the U.S. focusing on Indo-Pacific threats.

Formalization of EU-NATO collaboration through joint command structures.

Economic and Diplomatic Risks

Trade tensions: Trump may retaliate against EU defense protectionism by imposing tariffs on German auto exports.

Energy dependencies: Increased U.S. LNG purchases could lock Europe into long-term contracts, undermining renewable energy transitions.

Divisions within the EU: Eastern members like Poland and the Baltic states may resist reducing U.S. ties, fearing diminished deterrence against Russia.

Global Geopolitical Ramifications

U.S.-Europe Relations

Merz’s strategy risks exacerbating transatlantic strains. Trump has already criticized European leaders as “freeloaders,” and his administration may:

Withdraw additional troops from Germany, following the 2020 reduction of 12,000 personnel.

Block intelligence sharing with EU nations pursuing defense integration.

Russia’s Strategic Calculus

A fragmented NATO could embolden Moscow to test European resolve, particularly in the Balkans or the Arctic. However, a militarily cohesive EU might deter Russian aggression more effectively than a divided NATO.

China’s Opportunity

Beijing could exploit U.S.-Europe tensions by:

Offering to mediate in Ukraine to position itself as a global peacemaker.

Expanding investments in Central and Eastern Europe through the Belt and Road Initiative.

Challenges and Contradictions

Funding the Vision

Merz’s proposed defense bonds face resistance from fiscally conservative EU members like Sweden and the Netherlands. Even within Germany, constitutional debt limits (Schuldenbremse) may require parliamentary supermajorities to bypass.

Industrial Capacity Gaps

Europe’s defense industry lags behind the U.S. in critical areas:

Only 18% of EU defense spending goes to joint procurement, compared to 80% in the U.S..

The EU produces just 5% of the world’s semiconductors, vital for advanced weapons systems.

Political Cohesion

Divergent threat perceptions between member states—such as Poland’s focus on Russia versus Spain’s concerns about North Africa—could hinder consensus.

Conclusion

A Historic Inflection Point

Merz’s call for European defense independence represents the most significant shift in EU security policy since the 1950s.

While driven by necessity—Trump’s transactional unilateralism and Russia’s revanchism—the success of this vision hinges on overcoming entrenched national interests and resource constraints.

For Germany, the gamble is twofold: convincing skeptical allies to cede sovereignty to EU institutions while avoiding a complete rupture with Washington.

The June 2025 NATO summit will serve as a litmus test.

If Merz secures commitments for a parallel European defense framework, the EU could emerge as a cohesive geopolitical power.

Failure, however, might leave Europe trapped between an indifferent America and an assertive Russia—a scenario Merz has vowed to prevent.

As he told the Munich Security Conference: “We cannot afford nostalgia.

The future belongs to those who prepare for it”.