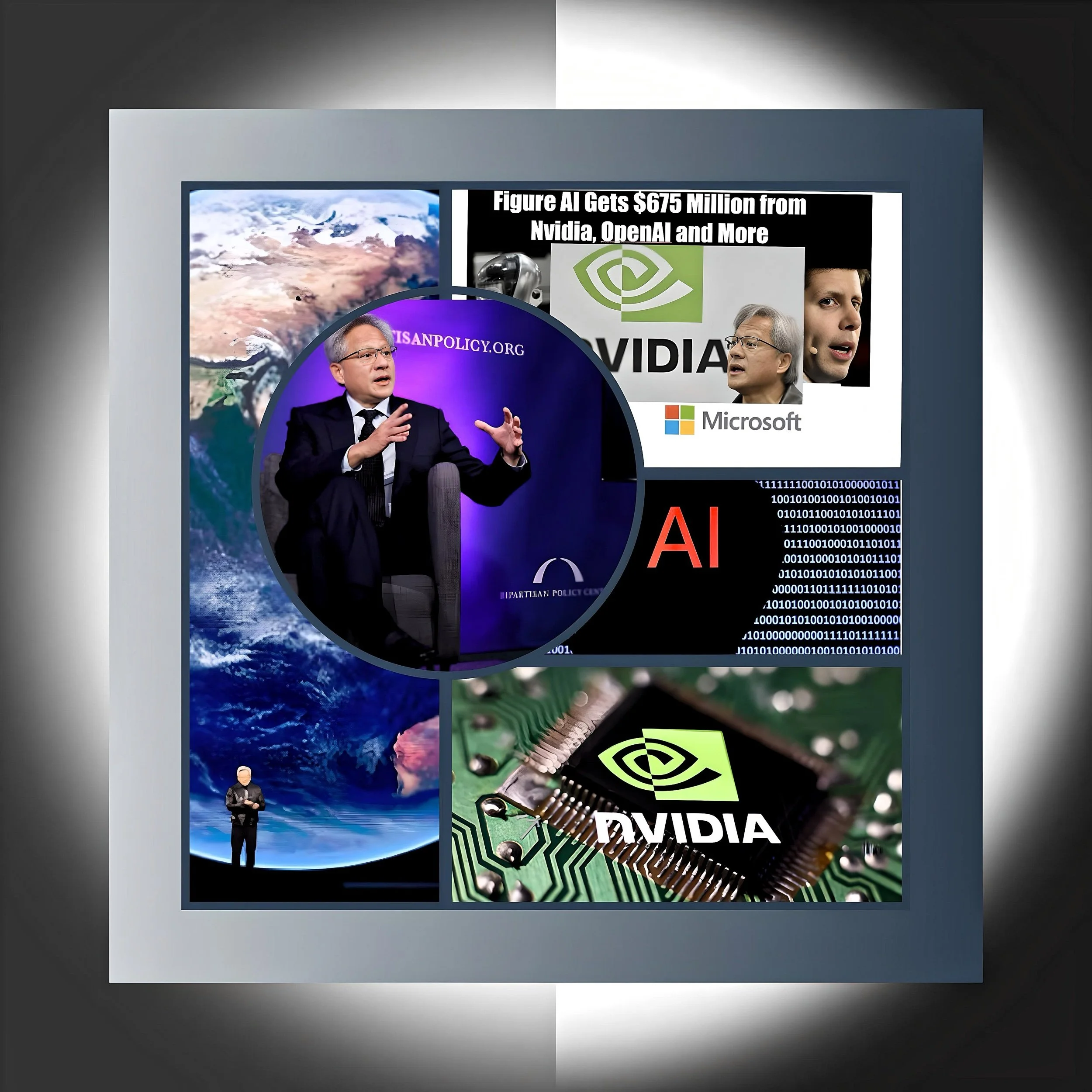

NVIDIA’s Strategic Investment in Figure AI: Accelerating the Future of Humanoid Robotics

Introduction

In a landmark move underscoring the convergence of artificial intelligence and advanced robotics, NVIDIA has emerged as a pivotal investor in Figure AI, a startup at the forefront of humanoid robotics development.

This strategic partnership, part of a broader $675 million Series B funding round announced in early 2024, positions NVIDIA alongside industry giants like Microsoft, OpenAI, and Jeff Bezos in backing one of the most ambitious ventures in autonomous systems.

The investment, totaling $50 million from NVIDIA, reflects the chipmaker’s aggressive expansion into AI-driven technologies and its vision for a future where humanoid robots seamlessly integrate into industrial and domestic environments.

NVIDIA’s Role in Figure AI’s Funding and Valuation Surge

The Series B Funding Round and Corporate Backing

NVIDIA’s participation in Figure AI’s $675 million Series B round marked a critical inflection point for the startup, elevating its pre-money valuation to $2.6 billion.

The round, led by Microsoft’s $95 million commitment and bolstered by Jeff Bezos’s $100 million investment through Explore Investments LLC, attracted a consortium of technology leaders, including Intel Capital, LG Innotek, and Samsung.

NVIDIA’s $50 million contribution, alongside an equivalent sum from an Amazon-affiliated fund, underscored the industry’s confidence in Figure AI’s potential to redefine labor markets through advanced robotics.

This funding influx enabled Figure AI to accelerate the commercial deployment of its flagship humanoid robot, Figure 01, designed for roles in manufacturing, logistics, and retail.

The robot’s capabilities, demonstrated in a viral video showcasing autonomous task execution, align with NVIDIA’s broader strategy to dominate AI infrastructure, from data centers to edge devices.

Strategic Synergies with OpenAI and Microsoft

A pivotal aspect of Figure AI’s trajectory is its collaboration with OpenAI, announced concurrently with the Series B funding.

This partnership aims to integrate OpenAI’s generative AI models, including GPT and DALL-E, into Figure 01’s cognitive architecture, enabling natural language processing and real-time decision-making.

NVIDIA’s involvement extends beyond capital; the company provides the computational backbone for training these AI models through its GPUs, which are integral to Microsoft’s Azure cloud services—the designated platform for Figure AI’s development pipeline.

The tripartite alliance between Figure AI, OpenAI, and NVIDIA exemplifies the convergence of hardware, software, and robotics.

As Peter Welinder, OpenAI’s VP of Product and Partnerships, noted, the collaboration seeks to “bridge the gap between AI’s theoretical potential and its physical embodiment,” a vision that aligns with NVIDIA’s focus on scalable AI solutions.

Market Context: NVIDIA’s Expanding AI Ecosystem

Investment Trends in AI and Robotics

NVIDIA’s investment in Figure AI is not an isolated maneuver but part of a calculated strategy to dominate the AI ecosystem.

In 2024 alone, NVIDIA participated in over ten funding rounds exceeding $100 million for AI startups, including notable deals with OpenAI, xAI, and Mistral AI.

The company’s venture capital arm, NVentur’s, has been particularly active, targeting startups that synergize with its GPU-driven infrastructure, such as CoreWeave (cloud computing) and Wayve (autonomous vehicles).

This aggressive investment approach has transformed NVIDIA into a linchpin of the AI industry, with its GPUs powering everything from large language models to robotic control systems.

As Jensen Huang, NVIDIA’s CEO, stated, “We invest in these companies because they’re incredible at what they do. These are some of the best minds in the world”.

Figure AI’s focus on humanoid robotics—a sector projected to reach $38 billion by 2035—complements NVIDIA’s dominance in AI accelerators, creating a vertical integration opportunity from silicon to autonomous systems.

Competitive Landscape and Industry Implications

The humanoid robotics space has become a battleground for tech titans, with Tesla’s Optimus, Boston Dynamics’ Atlas, and Amazon’s Digit vying for market share.

NVIDIA’s backing of Figure AI signals a strategic counter to these initiatives, particularly as Tesla accelerates its Optimus production timeline.

Figure 01’s differentiation lies in its emphasis on general-purpose functionality, enabled by OpenAI’s adaptive AI models, which allows it to perform diverse tasks without extensive retraining.

Moreover, NVIDIA’s investment aligns with broader industry trends toward addressing labor shortages and enhancing productivity.

BMW’s partnership with Figure AI to deploy robots in automotive manufacturing highlights the immediate industrial applications, while long-term prospects include domestic assistance and healthcare.

For NVIDIA, these deployments represent incremental demand for its AI chips, as each robot requires substantial computational power for perception, planning, and execution.

Financial and Strategic Outcomes for NVIDIA

Valuation Growth and Market Positioning

NVIDIA’s stake in Figure AI has already yielded significant valuation gains.

Following the Series B round, Figure AI’s valuation reached $2.6 billion, a figure poised to escalate to $39.5 billion pending a $1.5 billion funding round in early 2025.

This 15-fold increase in valuation within a year underscores the market’s bullish outlook on humanoid robotics and NVIDIA’s ability to identify high-growth ventures.

From a financial perspective, NVIDIA’s $50 million investment could appreciate exponentially if Figure AI achieves its production targets of 100,000 robots by 2028.

Assuming a conservative price point of $50,000 per unit, Figure AI’s revenue potential exceeds $5 billion annually, not accounting for software and service revenues.

For NVIDIA, this translates to sustained demand for its GPUs and AI platforms, further solidifying its market leadership.

Synergies with NVIDIA’s Core Business

Figure AI’s robotics platform relies heavily on NVIDIA’s Jetson modules for edge AI and Isaac Sim for simulation training, creating a direct revenue stream for the chipmaker.

Additionally, the collaboration with OpenAI necessitates cloud-based training on NVIDIA’s A100 and H100 GPUs, which are central to Microsoft Azure’s AI offerings.

This symbiosis between NVIDIA’s hardware and Figure AI’s applications exemplifies the company’s “ecosystem playbook,” where strategic investments drive adoption of its technology stack.

Furthermore, NVIDIA’s involvement in Figure AI enhances its credibility in the robotics sector, a critical frontier for AI adoption.

As Brett Adcock, Figure AI’s CEO, emphasized, “The fusion of NVIDIA’s computational prowess with our robotic systems will redefine what’s possible in automation”.

This sentiment resonates with NVIDIA’s long-term vision of ubiquitous AI, where intelligent machines operate alongside humans in diverse environments.

Challenges and Future Outlook

Technical and Regulatory Hurdles

Despite the optimism, Figure AI faces formidable challenges.

Humanoid robots require breakthroughs in energy efficiency, material science, and AI safety—areas where NVIDIA’s expertise in power-efficient GPUs and simulation tools could prove decisive.

Regulatory scrutiny, particularly regarding workplace safety and ethical AI use, also looms large. NVIDIA’s experience navigating global semiconductor regulations may aid Figure AI in compliance and standardization efforts.

Market Adoption and Competition

While Figure AI has secured partnerships with BMW and logistics firms, mass adoption hinges on cost reductions and proven reliability.

Tesla’s Optimus, priced at an anticipated $30,000, poses a significant competitive threat, leveraging Tesla’s manufacturing scale and Autopilot AI.

NVIDIA’s ability to drive down GPU costs through advancements like Blackwell architecture could help Figure AI maintain a pricing edge.

Conclusion

NVIDIA’s investment in Figure AI represents a strategic masterstroke, aligning the company’s AI hardware dominance with the transformative potential of humanoid robotics.

By anchoring Figure AI’s $675 million Series B round and fostering collaborations with OpenAI and Microsoft, NVIDIA has positioned itself at the nexus of AI innovation and physical automation.

As Figure AI progresses toward commercial deployment, NVIDIA stands to reap dual rewards: direct financial returns from its equity stake and expanded demand for its computational infrastructure.

In the broader context, this partnership underscores a pivotal shift in the AI landscape—one where intelligence transcends digital realms to inhabit dynamic, human-like machines capable of reshaping industries and everyday life.