Key reasons for economic crisis in Argentina

Introduction

Argentina’s economic crisis is a result of multiple interconnected factors, both domestic and global. 53% of Argentina’s population is reported as living in poverty during the first half of 2024. This significant increase from previous years marks the highest poverty rate in the country since 2003

Here are the key reasons:

1. Chronic Inflation

Persistent High Inflation Rates: Inflation in Argentina has been consistently high for decades, reaching over 140% annually in 2023. This erodes purchasing power and destabilizes the economy.

Devaluation of the Peso: The Argentine peso has experienced significant depreciation, further fueling inflation by increasing the cost of imports.

2. Unsustainable Debt

External Debt Burden: Argentina has a history of borrowing heavily from international creditors, including the IMF. Debt repayment obligations strain public finances, especially when the economy contracts.

Debt Defaults: Argentina has defaulted on its debt multiple times, most recently in 2020. This damages investor confidence and increases borrowing costs.

3. Political Instability and Policy Mismanagement

Frequent Changes in Economic Policy: Shifts between populist and market-oriented policies create uncertainty. Economic reforms are often short-lived, leading to inconsistent fiscal and monetary policies.

Lack of Confidence in Institutions: Political corruption and lack of transparency erode trust in the government and its ability to manage the economy effectively.

4. Structural Economic Issues

Overreliance on Agriculture: While Argentina is a major exporter of soybeans, corn, and beef, the economy is heavily dependent on commodity exports, making it vulnerable to price fluctuations in global markets.

Weak Industrial Base: The industrial sector is underdeveloped, limiting the country’s ability to diversify its economy and generate higher-value exports.

5. Currency Controls and Black Market

Capital Controls:

To protect foreign reserves, Argentina imposes strict currency controls, limiting access to foreign currency. This drives a black market for U.S. dollars, creating a dual exchange rate system.

Impact on Investment:

Capital controls deter foreign and domestic investment due to restricted financial flows and uncertainty over profit repatriation.

6. High Public Spending and Deficits

Subsidies and Welfare Programs: The government spends heavily on subsidies for energy, transport, and social welfare. While these policies aim to support lower-income groups, they strain public finances.

Fiscal Deficits: Chronic budget deficits require borrowing, exacerbating the debt problem and contributing to inflation.

7. External Shocks

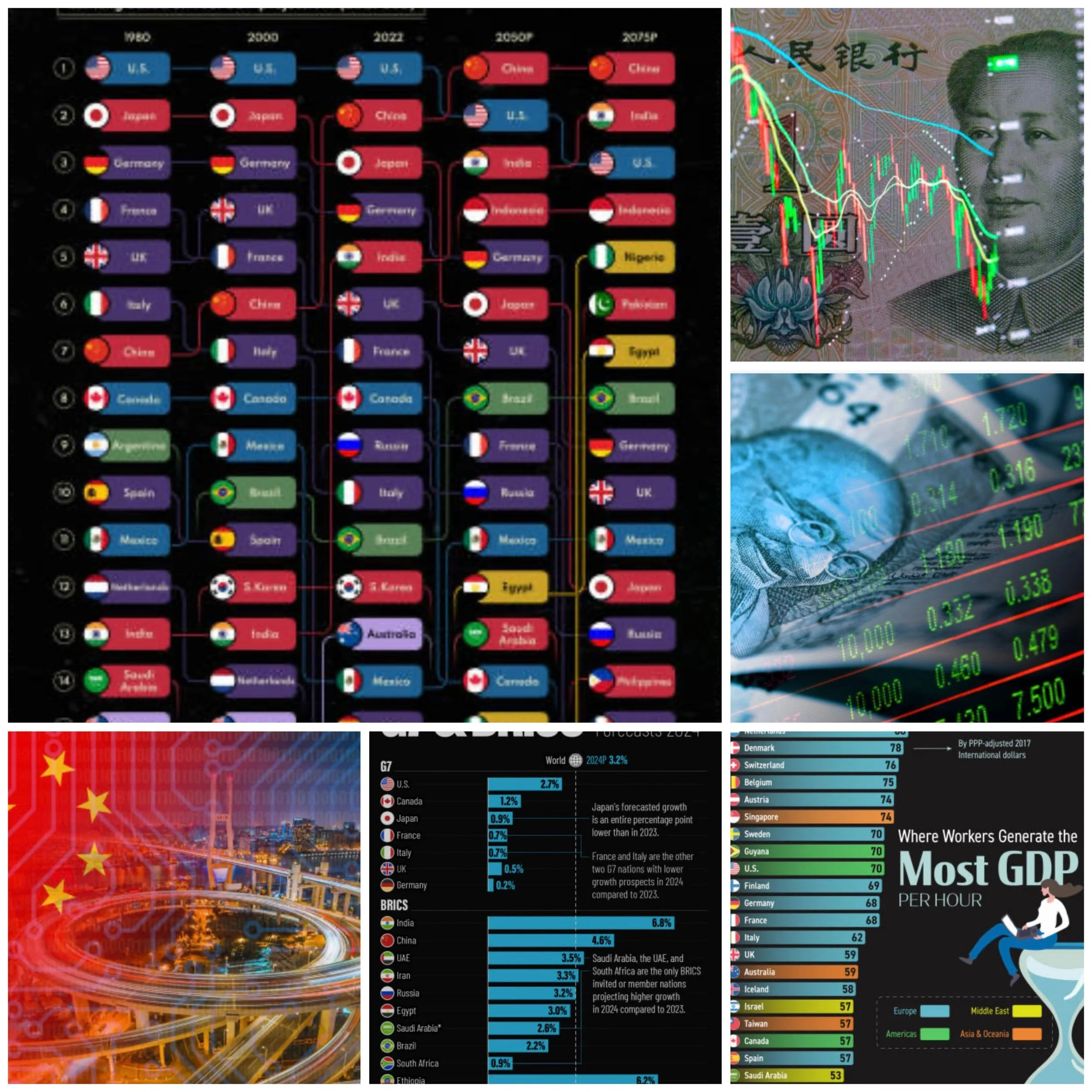

Global Economic Downturns: Economic slowdowns or recessions in key trading partners, like China or Brazil, reduce demand for Argentine exports.

Commodity Price Volatility: Dependence on agricultural exports makes Argentina vulnerable to swings in global commodity prices.

8. Energy Crisis

Reliance on Energy Imports: Despite having significant natural resources, Argentina faces energy shortages and imports energy at high costs, especially during peak demand periods.

Subsidy Pressure: Energy subsidies burden the fiscal budget, especially when global energy prices rise.

9. Social Inequality and Poverty

Growing Poverty Levels: Economic instability has pushed millions into poverty. In 2023, over 40% of the population lived below the poverty line.

Unemployment and Informal Sector:

High unemployment and a significant informal economy limit tax revenues and social mobility.

Conclusion

The Argentine economic crisis is a result of both long-term structural issues and immediate fiscal and monetary challenges. Addressing these problems requires comprehensive economic reforms, political stability, and effective management of external shocks.