US surviving foreign debt of $7.5 Trillion?

Introduction

The United States, one of the world's largest economies, has amassed a substantial amount of debt over the years. The accumulation of debt is a complex issue that impacts not only the nation's financial health but also its socio-economic landscape. This text aims to provide an insightful exploration of the challenges and implications of the US debt, shedding light on its causes, consequences, and potential solutions.

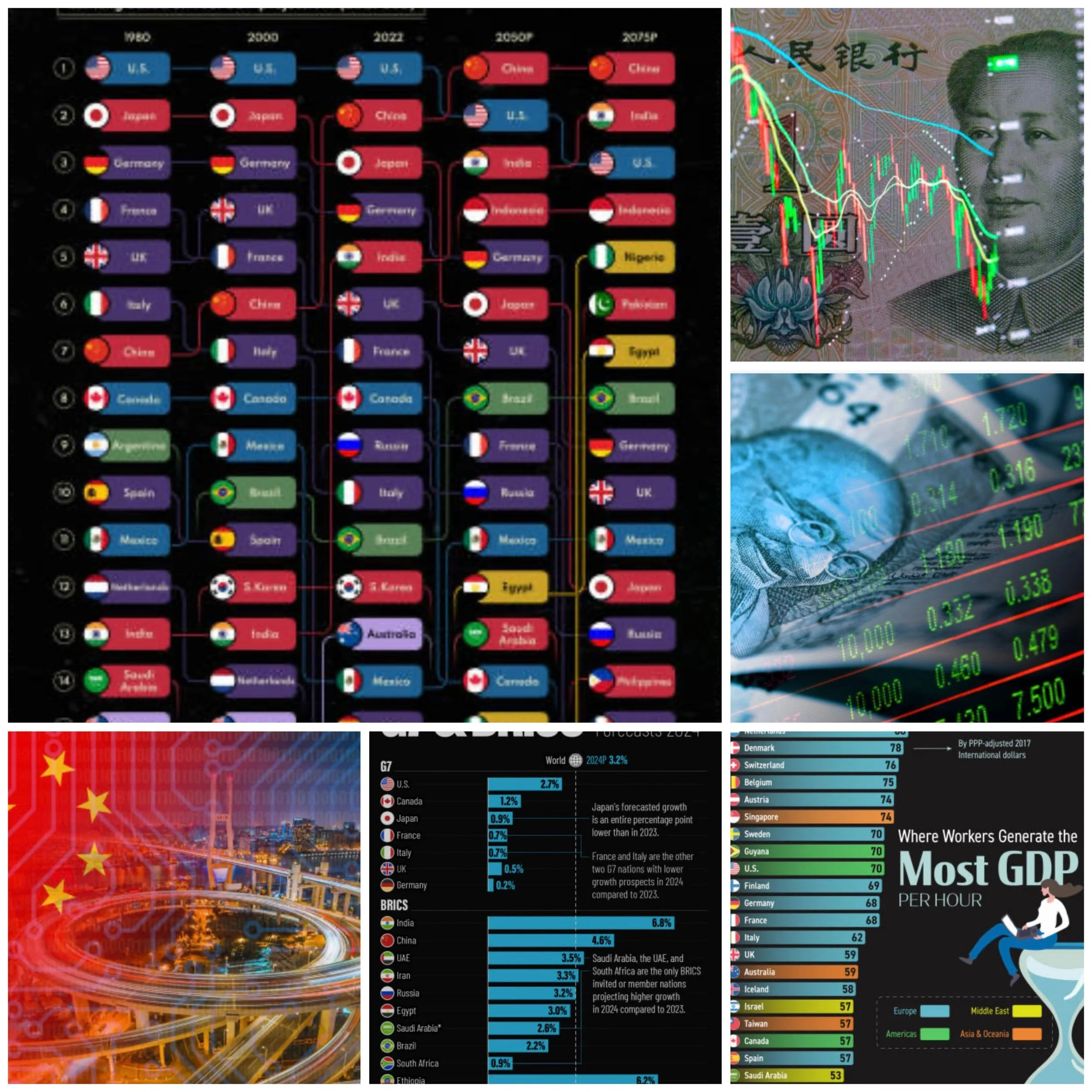

The US debt refers to the outstanding financial obligations that the US government has incurred over time. It primarily consists of Treasury bills, notes, and bonds issued to finance government spending, budget deficits, and various public programs. In 2023 the US national debt is more than $ 31 trillion, or 136.62% of US GDP. In absolute numbers, the United States is the leader in public debt.

There are several key factors contributing to the US debt. One of the primary drivers is government spending, which includes expenditures on defense, social programs, infrastructure, and interest on the debt itself. Additionally, economic downturns, such as recessions, can lead to decreased tax revenues and increased government spending, further exacerbating the debt burden. Since WWII, US has given over $3.75 trillion in foreign aid. In short US gives $30 billion aid every year. Whereas China gives maximum $4.5 billion aid. What does that tell you? US gave a $113 billion aid to Ukraine. So question is how does US adjust $30 billion aid it gives out every year?

The implications of the US debt are multifaceted and far-reaching. One of the primary concerns is the potential strain on future generations. As the debt accumulates, interest payments grow, consuming a larger portion of the federal budget. This leaves fewer resources for critical investments in areas such as education, healthcare, and infrastructure, impacting the long-term economic growth and well-being of the country.

Furthermore, the US debt has implications for global financial stability. As the largest borrower in the world, any negative developments regarding the debt can have far-reaching consequences on global markets, interest rates, and investor sentiment. This has the potential to impact international trade, investment flows, and the value of the US dollar.

Addressing the US debt requires a multifaceted approach. Fiscal responsibility, prudent spending, and targeted reforms to reduce the budget deficit play a vital role. Additionally, exploring strategies to stimulate economic growth, enhance tax revenues, and prioritize investments can contribute to a more sustainable debt trajectory.

The US debt poses significant challenges and implications for the nation's financial health and future generations. Understanding the causes, consequences, and potential solutions is crucial in addressing this complex issue. By fostering fiscal discipline, promoting economic growth, and implementing targeted reforms, there is a possibility to steer the US debt on a more sustainable path, ensuring the stability and prosperity of the nation in the long term.

History

The US debt has a long and complex history, reflecting the economic challenges, crises, and policy decisions that have shaped the nation's financial landscape over the years. This chapter explores the key milestones and factors that have contributed to the accumulation of the US debt, shedding light on its evolution and implications.

The origins of the US debt can be traced back to the American Revolutionary War (1775 – 1783), when the newly formed United States borrowed funds to finance the war effort and establish the foundations of the new nation. Over time, the debt grew as the government continued to borrow to finance various endeavors, including wars, infrastructure projects, and social programs.

One of the significant events in the history of the US debt was the Great Depression in the 1930s. As the country struggled with economic turmoil, increased government spending and stimulus programs led to a significant increase in the debt. This period also marked the introduction of government bonds and Treasury securities as a means to borrow from the public.

In the post-World War II (1939 – 1945) era, the US debt surged again due to the costs associated with reconstruction, the Cold War, and the expansion of social welfare programs. However, during the 1990s, a period of economic growth and fiscal discipline, the US experienced a brief period of budget surpluses, allowing for a reduction in the debt.

The early 21st century witnessed a rapid increase in the US debt, largely driven by factors such as tax cuts, increased military spending, and the response to economic recessions. The financial crisis of 2008 and subsequent stimulus measures further contributed to the growth of the debt.

Russian President Vladimir Putin has expressed concerns about the United States' national debt on multiple occasions. He has criticized the US for accumulating massive levels of debt, emphasizing the potential risks this poses to the global economy. Putin has argued that excessive borrowing by the US government could lead to instability and provoke financial crises. While some view his comments as a political maneuver, others see them as a valid point of concern. Regardless of the motives behind Putin's remarks, it is clear that the size of the US national debt warrants attention and raises important questions about its long-term sustainability and impact on the global financial system.

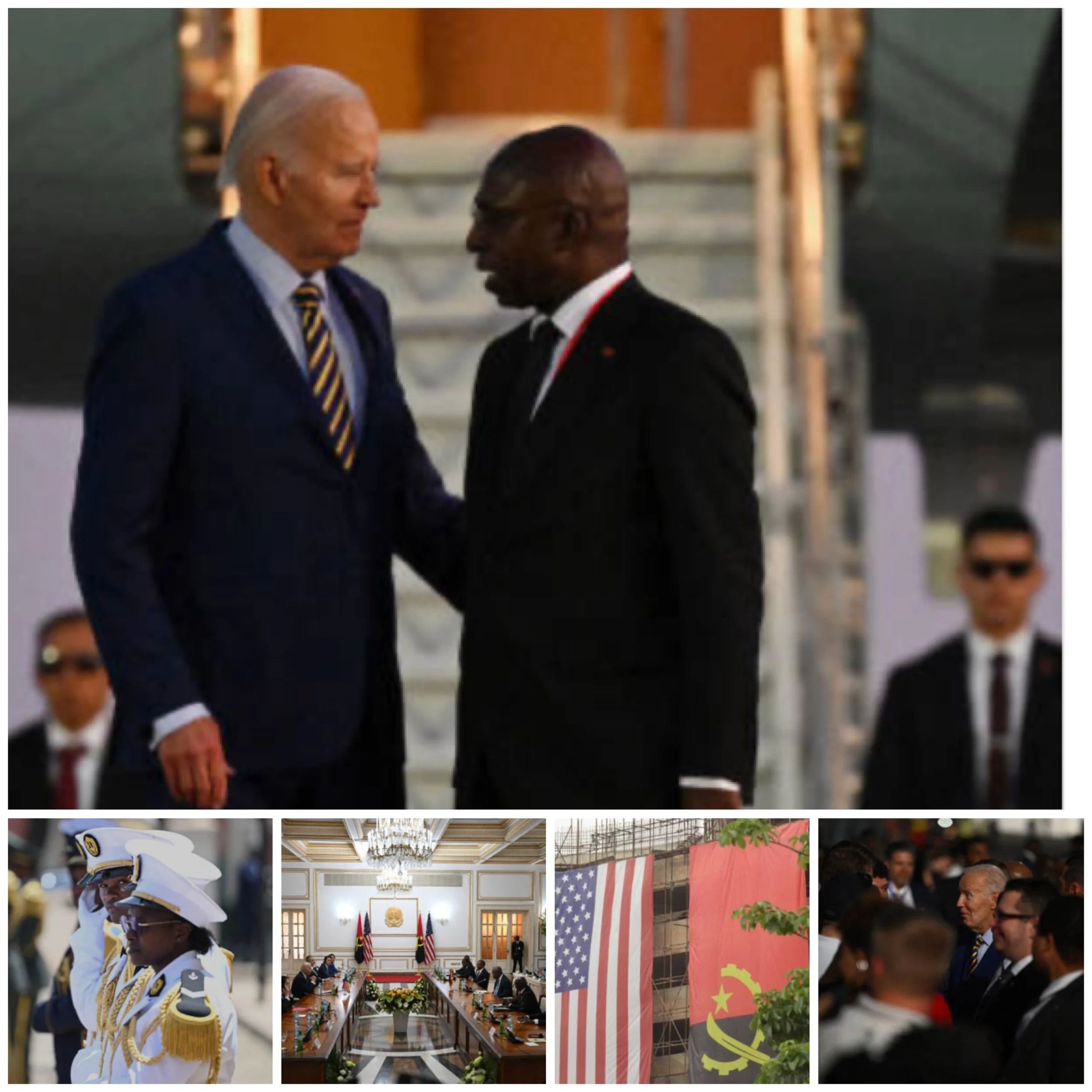

As the President of the United States, Joe Biden inherited a significant national debt. While addressing the issue of the US national debt is a complex and challenging task, President Biden has emphasize the need for responsible fiscal management. He has proposed policies focused on stimulating economic growth while simultaneously addressing the growing debt burden. Biden has called for targeted investments in infrastructure, education, and healthcare, with the aim of boosting productivity and creating long-term sustainability. However, his approach has faced criticism from those who argue that increased government spending may further exacerbate the debt problem. Addressing the national debt remains one of the key challenges facing the Biden administration as it navigates fiscal policy in the coming years.

Today, the US debt stands at trillions of dollars, continuing to rise due to ongoing government spending and budget deficits. The debt burden has significant implications for future generations, as interest payments increasingly consume a larger portion of the federal budget and limit funding for critical investments.

Facts

The United States government utilizes various types of debt instruments to finance its budget deficits and meet its financial obligations. Understanding these different types of US debt is essential in comprehending the complexity and magnitude of the nation's debt burden.

1. Treasury Bills (T-Bills): T-Bills are short-term debt instruments with maturities of one year or less. They are sold at a discount to their face value and provide returns to investors upon maturity. T-Bills are commonly used to manage short-term cash flow needs and are considered a safe and liquid investment.

2. Treasury Notes (T-Notes): T-Notes are medium-term debt securities with maturities ranging from two to ten years. They pay semi-annual interest to investors and are issued with fixed coupon rates. T-Notes provide investors with a longer-term investment option while still maintaining a relatively low risk compared to other types of debt.

3. Treasury Bonds (T-Bonds): T-Bonds are long-term debt instruments with maturities typically ranging from ten to thirty years. Like T-Notes, they pay semi-annual interest, but they have a longer duration and provide investors with more extended cash flow streams. T-Bonds are often sought after by institutional investors.

4. Treasury Inflation-Protected Securities (TIPS): TIPS are designed to protect investors against inflation. The principal value of these securities adjusts based on changes in the Consumer Price Index (CPI), ensuring that the investment retains its purchasing power. TIPS are issued with maturities of five, ten, or thirty years.

5. US Savings Bonds: US Savings Bonds are debt securities issued by the US Department of the Treasury for individual investors. These low-risk bonds are non-marketable, meaning they cannot be bought or sold in the secondary market. They offer a fixed interest rate, and their values grow over time until reaching their maturity.

Understanding these different types of US debt helps to paint a comprehensive picture of the borrowing methods employed by the government. Investors, policymakers, and the general public can assess the risks, rewards, and implications of the various debt instruments as they navigate the landscape of US public finance.

The United States' extensive debt burden is not solely owed domestically; it extends to countries across the globe. Among these international creditors, Japan, China, the United Kingdom, Belgium, and Luxembourg hold substantial amounts of US debt. Understanding these relationships is crucial in comprehending the intricate web of global finance and the implications of the US debt.

Japan is the largest foreign holder of US debt. In 2023, Japan's holdings amount to over $1.25 trillion. The close economic ties between the two nations, coupled with Japan's desire to maintain a stable currency exchange rate, contribute to its significant investment in US Treasury securities. Japan's large-scale purchases of US debt help finance the US budget deficit and provide stability to the US bond market.

China is the second-largest foreign holder of US debt, with holdings surpassing $1 trillion. China's accumulation of US Treasury securities stems from the need to diversify its vast foreign exchange reserves and to keep its own currency, the yuan, relatively stable. Despite occasional concerns over the scale of China's holdings, the mutual interdependence between the two largest economies in the world incentivizes continued investment.

The United Kingdom also holds a substantial amount of US debt, with holdings reaching several hundred billion dollars. The historical, economic, and political ties between the US and the UK strengthen this mutual investment. The United Kingdom's holdings of US debt include both private investors and government institutions, diversifying its investment portfolio and supporting a stable global financial system.

Belgium and Luxembourg, although smaller in size compared to Japan and China, also play notable roles as US debt holders. These countries, particularly their financial institutions, serve as intermediaries for foreign investors seeking to invest in US Treasury securities. This practice can lead to temporary increases in holdings, temporarily inflating the debt figures for these countries.

The debt obligations between the United States and these countries create intricate relationships that are both interconnected and complex. The international investors' willingness to hold US debt instruments reflects their confidence in the stability of the US economy and the world's trust in the US dollar. However, it is essential to recognize that the US debt is subject to global economic shifts, geopolitical dynamics, and changing investor sentiment.

Japan, China, the United Kingdom, Belgium, and Luxembourg are among the significant foreign holders of US debt. These countries' investments in US Treasury securities support the US economy by financing the budget deficit and providing stability to global financial markets. The mutual interdependence between the United States and its international creditors reinforces the need for responsible fiscal policies, collaborative economic relationships, and continuous efforts to maintain a sustainable debt trajectory.

The decision to provide financial aid to Ukraine, despite the US being in debt, is a complex issue that requires a nuanced understanding of international politics and economics. While it may seem counterintuitive, there are several important reasons behind this decision.

According to the German research institute of the Kiel Institute of World Economy, since the beginning of the war, the Biden administration and the US Congress have sent Ukraine more than $75 billion in aid, which includes humanitarian, financial and military support.

Firstly, it is crucial to recognize that the US provides aid to various countries as part of its foreign policy objectives. Providing financial assistance to Ukraine serves as a means to support a strategically important country in a volatile region. Ukraine is locked in a conflict with Russia (2014 – present), which has already annexed Crimea in 2014 and continues to destabilize the eastern part of the country. By supporting Ukraine, the US aims to maintain stability in the region and prevent further aggression by Russia.

Furthermore, the financial aid given to Ukraine is not solely aimed at helping the country out of its economic challenges. Assistance packages often come with strings attached, such as economic and political reforms. The US uses aid as leverage to push for democratic reforms, anti-corruption measures, and economic liberalization, ultimately aiming to strengthen Ukraine's institutions and align its policies more closely with Western nations.

Another aspect to consider is the potential impact on global stability. Instability in Ukraine could have far-reaching consequences that could negatively affect the global economy and security. By providing aid, the US seeks to prevent a complete economic collapse in Ukraine, as the consequences would have a domino effect on neighboring countries and potentially even further afield.

While the US certainly has its own domestic economic challenges, such as its national debt, it cannot isolate itself from the interconnected dynamics of global affairs. Providing financial aid to Ukraine is a calculated decision based on geopolitical interests, maintaining stability in a critical region, and promoting democratic values. It should not be viewed solely through the lens of US debt, but rather as part of a broader strategy to protect national interests and international stability.

On August 1, Fitch Ratings made a significant decision by removing the United States government's triple-A credit rating, following in the footsteps of another major credit-rating firm. This move has ignited a debate in Washington, focusing on the implications of this assessment and the need for adjustments in spending and tax policies. The removal of the triple-A rating raises concerns about the government's ability to meet its financial obligations and highlights the importance of fiscal responsibility and effective economic policies in maintaining a strong creditworthiness. The debate spurred by this decision underscores the need for careful consideration of economic strategies and the pursuit of sustainable fiscal practices.

Conclusion

The US debt represents a critical challenge that requires careful attention and prudent action. The accumulation of debt over the years highlights the complex factors that contribute to this burden, including government spending, economic downturns, and geopolitical dynamics. The implications of the US debt are far-reaching, affecting future generations, global financial stability, and the allocation of resources for critical investments.

Addressing the US debt requires a multifaceted approach. Fiscal responsibility, such as reducing budget deficits, streamlining expenditures, and promoting sustainable economic growth, is vital to alleviate the debt burden. Exploring avenues for revenue generation, such as tax reform and increased economic productivity, can also play a role in reducing the debt.

Additionally, long-term solutions should involve reforms to entitlement programs, stability in government finances, and political commitment to accountable budget practices. It is crucial to find a balance between managing the debt and maintaining investments in critical areas such as education, infrastructure, and research and development.

Furthermore, cooperation among policymakers, government institutions, and the public is essential in addressing the US debt. Open dialogue, transparency, and informed decision-making can contribute to responsible fiscal management and establish a sustainable path for future generations.

In summary, the US debt is a complex issue that demands attention and action. By implementing responsible fiscal policies, promoting economic growth, and fostering a culture of responsible financial management, the US can address its debt burden and ensure a prosperous future for the nation. It is an ongoing effort that requires long-term planning, collaboration, and sound policy decisions to navigate the path towards fiscal sustainability.