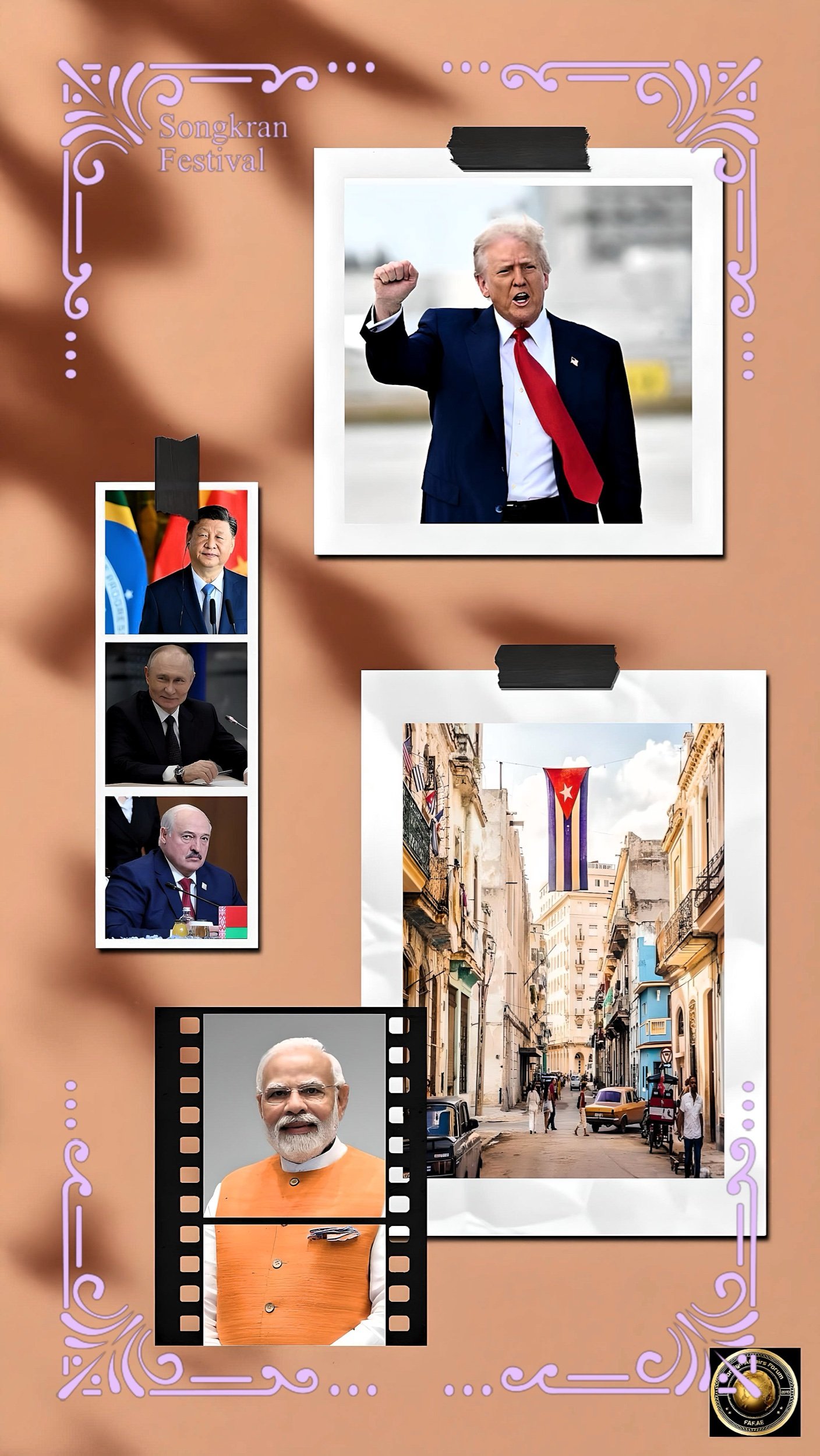

Countries Spared or Benefiting from Trump’s Tariffs: Exemptions, Strategies, and Responses

Introduction

President Donald Trump’s sweeping tariff policy, initiated in early 2025, has dramatically reshaped the global trade landscape. While most nations faced new tariffs ranging from 10% to as high as 50%, certain countries were either completely exempted or received special treatment.

FAF examines which countries were spared, which received beneficial exemptions, and the strategies various nations employ to navigate this new protectionist environment.

Complete Exemptions: The Notable Absentees

Russia: Strategic Omission or Practical Reality?

Russia stands as perhaps the most conspicuous absence from Trump’s tariff list. The official White House explanation claimed that existing sanctions had already reduced US-Russia trade to minimal levels, making additional tariffs unnecessary. Press Secretary Karoline Leavitt stated that sanctions already “preclude any meaningful trade” between the two nations.

However, this justification has raised questions among analysts. Despite the significant decline in US—Russian trade—from $35 billion in 2021 to just $3.5 billion in 2024—the United States still conducts more trade with Russia than with several smaller nations that were included on the tariff list, such as Mauritius and Brunei.

Saurav Ghosh, co-founder of the bond investment platform Jiraaf, suggested an alternative explanation: ongoing negotiations between Trump and Russian President Vladimir Putin regarding Ukraine.

If Trump was engaged in talks with Putin about ending the Ukraine war, maintaining economic cooperation with Russia might be diplomatically advantageous.

North Korea, Cuba, and Belarus: The Sanctioned Bloc

North Korea, Cuba, and Belarus were similarly absent from Trump’s tariff announcements. As with Russia, the Trump administration cited high tariffs and sanctions that had already limited meaningful trade with these countries.

The exemption pattern reveals an interesting dichotomy in Trump’s approach: while traditional adversaries like Russia and North Korea avoided new tariffs, traditional allies such as the European Union (20% tariff) and Israel (17% tariff) were not spared. Even more striking, Iran—a longstanding adversary—received only a 10% baseline tariff, lower than the rate applied to Israel.

Partial Exemptions: Strategic Carve-Outs

Canada and Mexico: The USMCA Shield

While Canada and Mexico were not named in Trump’s April 2 tariff announcement, both countries had already been subjected to earlier trade penalties, including a 25% tariff on imports and a 10% rate targeting Canadian energy and potash. However, significant exemptions were granted for these neighboring nations:

Goods covered by the US-Mexico-Canada Agreement (USMCA) remain exempt from the new duties.

President Trump signed orders expanding exemptions for Canada and Mexico, which benefited the automotive industry.

Tariffs on potash—a key ingredient in fertilizer needed by US farmers—were reduced from 25% to 10%.

These exemptions reflect the deeply integrated North American supply chains, especially in the automotive sector.

Canadian Prime Harvey engaged in what he described as a “colorful” conversation with Trump regarding tariffs. At the same time, Mexican President Sheinbaum thanked Trump for the move and pledged to work together on issues such as stemming the flow of fentanyl.

Electronics Industry: Product-Specific Relief

On April 12, 2025, the Trump administration exempted smartphones, computers, and other electronics from the reciprocal tariffs. This exemption benefited tech giants like Apple and Samsung, which produce a substantial portion of their products in China.

The exclusions narrowed the scope of the levies by exempting these products from Trump’s 125% China tariff and his baseline 10% global tariff on nearly all other countries. Specific exempted items included:

Smartphones

Laptop computers

Hard drives

Computer processors

Memory chips

Semiconductor chips

Solar cells

Flat-panel television displays

Flash drives and memory cards

This exemption relieved consumers who would have otherwise faced significant price increases and helped stabilize the market position of major tech companies.

Apple, which manufactures over 80% of its products in China (including 80% of iPads and more than half of its Mac computers), had previously lost over $640 billion in market value following Trump’s tariff announcement.

Strategic Responses from Affected Nations

Zimbabwe: Preemptive Tariff Elimination

Zimbabwe faced an 18% tariff under Trump’s plan but adopted a bold and unique strategy in response. On April 6, 2025, President Emmerson Mnangagwa announced plans to eliminate tariffs on all goods imported from the US entirely.

Following Trump's announcement, Zimbabwe was the first to scrap tariffs on US goods unilaterally.

Mnangagwa framed this decision as an attempt to “construct a mutually beneficial and positive relationship” with the US under Trump’s leadership. He stated that the measure was “intended to facilitate the expansion of American imports within the Zimbabwean market while simultaneously promoting the growth of Zimbabwean exports destined for the United States.”

South Korea: Negotiation Over Retaliation

Facing a 25% tariff on its exports to the US, South Korea’s government announced emergency support for its auto industry. Acting President Han Duck-soo called for negotiation rather than retaliation, and South Korea’s finance minister planned meetings with the US Trade Representative for talks.

Trump indicated that he had discussed the tariffs with Han in a phone call, suggesting that diplomatic channels remained open despite the initial tariff imposition.

Singapore: Task Force Formation

Singapore, which received a 10% baseline tariff, established a national task force to support businesses and workers affected by the tariffs. In an address to the Singapore Parliament, Prime Minister Lawrence Wong criticized the US approach, stating that “what the U.S. is doing now is not reform” and that “these measures will accelerate the fracturing of the global economy.”

Despite this criticism, the Singaporean government announced it would not retaliate against US tariffs, preferring to seek resolution through other means.

South Africa: Diversification Strategy

South Africa, hit with a 30% tariff, chose not to retaliate but to negotiate for exemptions. Trade and Industry Minister Parks Tau also announced plans to diversify the country’s export markets, targeting regions in Asia, Europe, the Middle East, and Africa.

Due to market uncertainty, the tariffs had immediate economic consequences in South Africa, including the postponement of gem sales from the Cullinan Mine.

Corporate Adaptation Strategies

Companies affected by the tariffs have employed several strategies to mitigate their impact:

Relocating Production

Some businesses have moved final assembly to the United States to avoid tariffs. For example, NOBL Wheels, a Canadian producer of bicycle wheels, established a new operation in Bellingham, Washington, to provide “tariff-free” shipping.

Sourcing Diversification

Companies have considered shifting sourcing from highly-tariffed nations like China to countries currently outside the scope of the trade conflict, such as Vietnam, Malaysia, or Thailand.

Product Reclassification and Redesigning

Some businesses have employed “tariff engineering” by modifying their products or reclassifying them to qualify for lower tariff rates.

Seeking Exemptions

Many firms and trade associations have requested exemptions through the Office of the US Trade Representative via Section 301 requests. Between 2018 and 2021, during Trump’s first term, the USTR received over 53,000 exclusion requests, approving approximately 13%.

Inventory Stockpiling: In anticipation of tariffs, companies like Apple chartered cargo flights to rapidly build inventory in the United States, shipping an estimated 1.5 million iPhones weighing approximately 600 tons from India to the US.

Conclusion

President Trump’s tariff policy has created a complex landscape of winners and losers in global trade.

While most nations face new barriers in the US market, certain countries—notably Russia, North Korea, Cuba, and Belarus—have been completely exempted. Canada and Mexico have secured significant carve-outs through the USMCA, and the electronics industry has received special protection.

Nations have responded with varying strategies, from Zimbabwe’s preemptive tariff elimination to South Korea’s diplomatic engagement and South Africa’s market diversification.

These approaches reflect each country’s unique relationship with the United States and their respective economic vulnerabilities.

As these tariff policies continue to evolve—with some already being paused or adjusted—the global trade landscape remains in flux, requiring continued adaptation from nations and businesses alike.