The Evolution of China’s Manufacturing Ecosystem: From Agrarian Roots to AI-Driven Powerhouse

Introduction

China’s manufacturing ecosystem has undergone a transformative journey over centuries, evolving from agrarian-based handicrafts to a global leader in advanced, AI-integrated production.

FAF research traces the sector’s development through six distinct eras, analyzing the policies, technologies, and strategic pivots that enabled China to capture 30% of global manufacturing output by 2025.

Imperial Foundations to Industrial Awakening

Pre-1949

Silk Road Beginnings and Early Industrialization

China’s manufacturing legacy dates back to 100 BCE when Silk Road trade networks exported silk, porcelain, and spices. However, modern industrialization began in 1862 with the Anqing Ordnance Institute, the first machinery factory established during the Westernization Movement. This state-owned facility pioneered steam engine production (1862) and China’s first steamship (1866), marking the birth of mechanized manufacturing.

Beiyang Era Growth (1912–1927)

The post-imperial Beiyang government catalyzed national capitalism by removing barriers to private industry. Over 26 state-backed “machine bureaus” emerged, producing armaments and machinery while fostering technical expertise. By 1927, domestic firms like Yongli Chemical and Dasheng Cotton Mills demonstrated China’s capacity for scaled production, though reliance on foreign technology persisted.

Planned Economy Foundations (1949–1978)

Soviet-Style Industrialization

Post-1949, China adopted a centrally planned model emphasizing heavy industry. With Soviet aid, 156 key projects launched during the First Five-Year Plan (1953–1957) established steel mills, machinery plants, and defense factories. By 1960, industrial output grew 19.6% annually, though the Great Leap Forward’s backyard furnaces caused quality control crises.

Self-Reliance and Third-Front Construction

The Sino-Soviet split (1960) prompted Mao’s Third Front strategy (1964–1978), relocating industries to inland provinces like Sichuan. This militarized industrialization built 1,100 state-owned enterprises (SOEs) but created inefficient, geographically isolated production networks.

Reform and Global Integration (1978–2001)

Special Economic Zones and Joint Ventures

Deng Xiaoping’s 1978 reforms unleashed market forces through Special Economic Zones (SEZs). Shenzhen’s GDP exploded from $27 million (1980) to $475 billion (2023), fueled by export-oriented manufacturing and foreign joint ventures. The 1979 Equity Joint Venture Law attracted $21.1 billion in manufacturing FDI by 1995.

WTO Accession and Supply Chain Formation

China’s 2001 WTO entry accelerated integration into global value chains. Exports surged from $266 billion (2000) to $2.5 trillion (2022), with coastal hubs like the Pearl River Delta becoming electronics assembly epicenters. By 2005, China produced 70% of the world’s toys and 60% of bicycles.

The “World’s Factory” Era (2001–2012)

Infrastructure Mega-Projects

A $1.1 trillion infrastructure boom (2008–2013) transformed logistics:

High-speed rail expanded from 0 to 19,000 km (2008–2015)

Port capacity reached 8.5 billion tons (2015)

4G networks covered 95% of villages by 2017

Industrial Policy 2.0

The 2006 Medium—and Long-Term Plan for Science and Technology Development targeted indigenous innovation. R&D spending jumped from 0.9% of GDP (2000) to 2.1% of GDP (2012), yielding breakthroughs in high-speed rail and telecommunications.

High-Tech Transformation (2012–Present)

Made in China 2025 Strategic Priorities

Launched in 2015, this initiative aims for 70% self-sufficiency in 10 strategic sectors by 2049:

Advanced IT

Robotics

Aerospace

Maritime engineering

New energy vehicles

Power equipment

Agricultural machinery

New materials

Biopharma

Medical devices

AI-Driven Smart Manufacturing

China’s 421 national smart factories (2024) leverage AI for mass customization. At Lenovo’s Hefei plant, AI algorithms process 8,000 daily orders (95% <5 units), reducing scheduling errors by 37%.

Provincial digital workshops now exceed 10,000, with Harbin Electric’s welding robots boosting precision by 40%.

Sustainable and Resilient Manufacturing (2025 Onward)

Green Industrial Policy

Facing 2.5 billion tons of annual CO₂ emissions, China’s 2025 Environmental Law mandates:

20% reduction in energy intensity by 2030

40% industrial water reuse rate

70% solid waste recycling in industrial parks

Tax incentives like 15% CIT for high-tech firms and 200% R&D deductions drive eco-innovation. BYD’s carbon-neutral EV factory in Shenzhen exemplifies this shift.

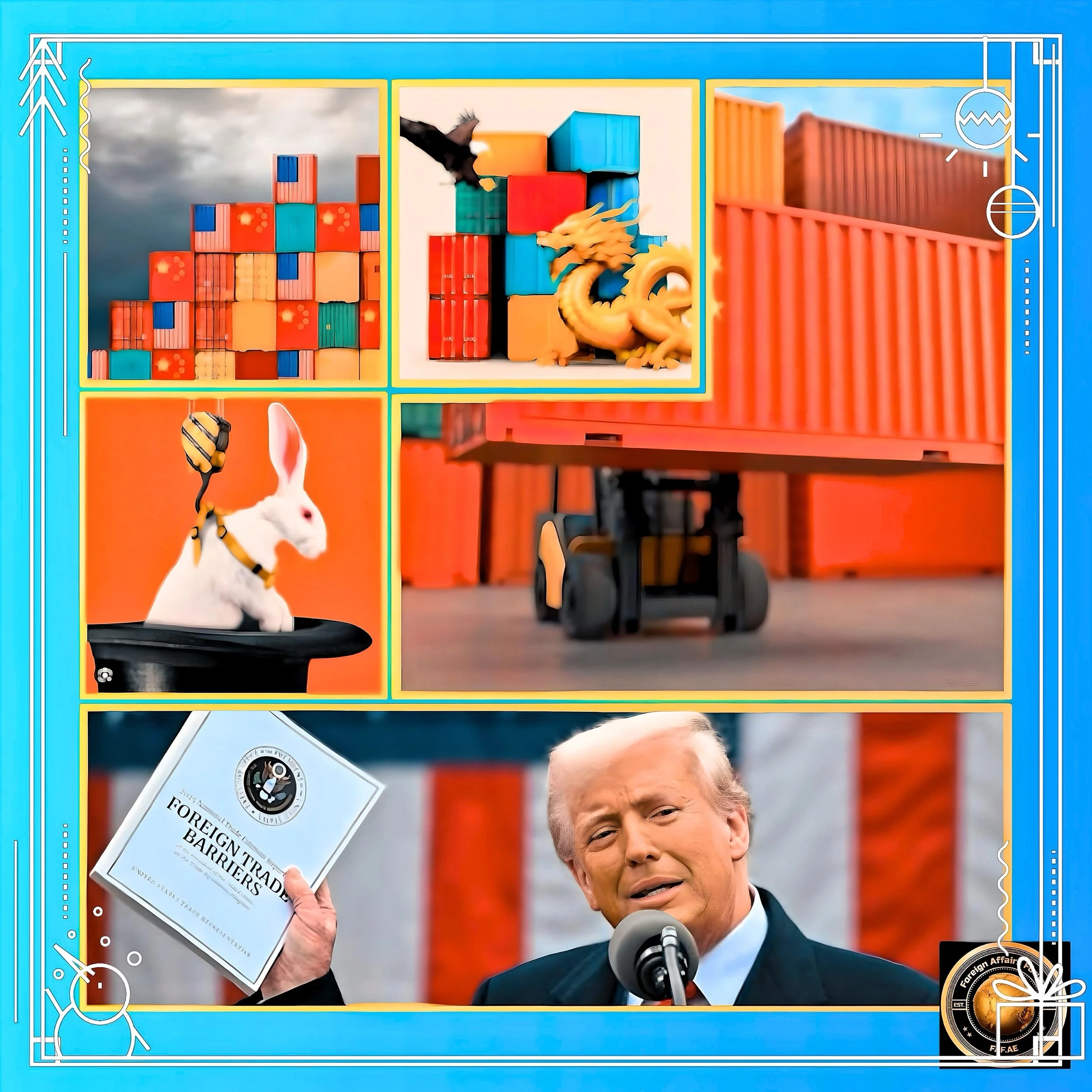

Geopolitical Adaptation

Despite U.S. tariffs hitting 125% (2025), China’s BRI has diversified exports to 147 countries. ASEAN trade reached $911 billion in 2024, offsetting declining U.S. shares. Domestic consumption now drives 55% of growth, up from 35% in 2010.

Conclusion: The Ecosystem’s Competitive Edge

China’s manufacturing dominance stems from three mutually reinforcing pillars:

Policy Continuity

From 1978 reforms to Made in China 2025, 40+ years of strategic industrial planning

Workforce Development

3.5 million annual STEM graduates + 500,000 vocational trainees

Tech Stack Integration

5G (1.3 million base stations) + AI (14% of global patents) + robotics (45% of installations)

However, challenges persist. An aging population (21% over 60 by 2035) and $1.4 trillion local government debt require rebalancing toward productivity-driven growth.

As AI reshapes global value chains, China’s ability to marry scale with innovation will determine whether it transitions from the “world’s factory” to the “world’s laboratory.”