Gold prices future in midst of tariff war globally - Gold to reach $4000 ( 2025) $10,000 by 2030

Introduction

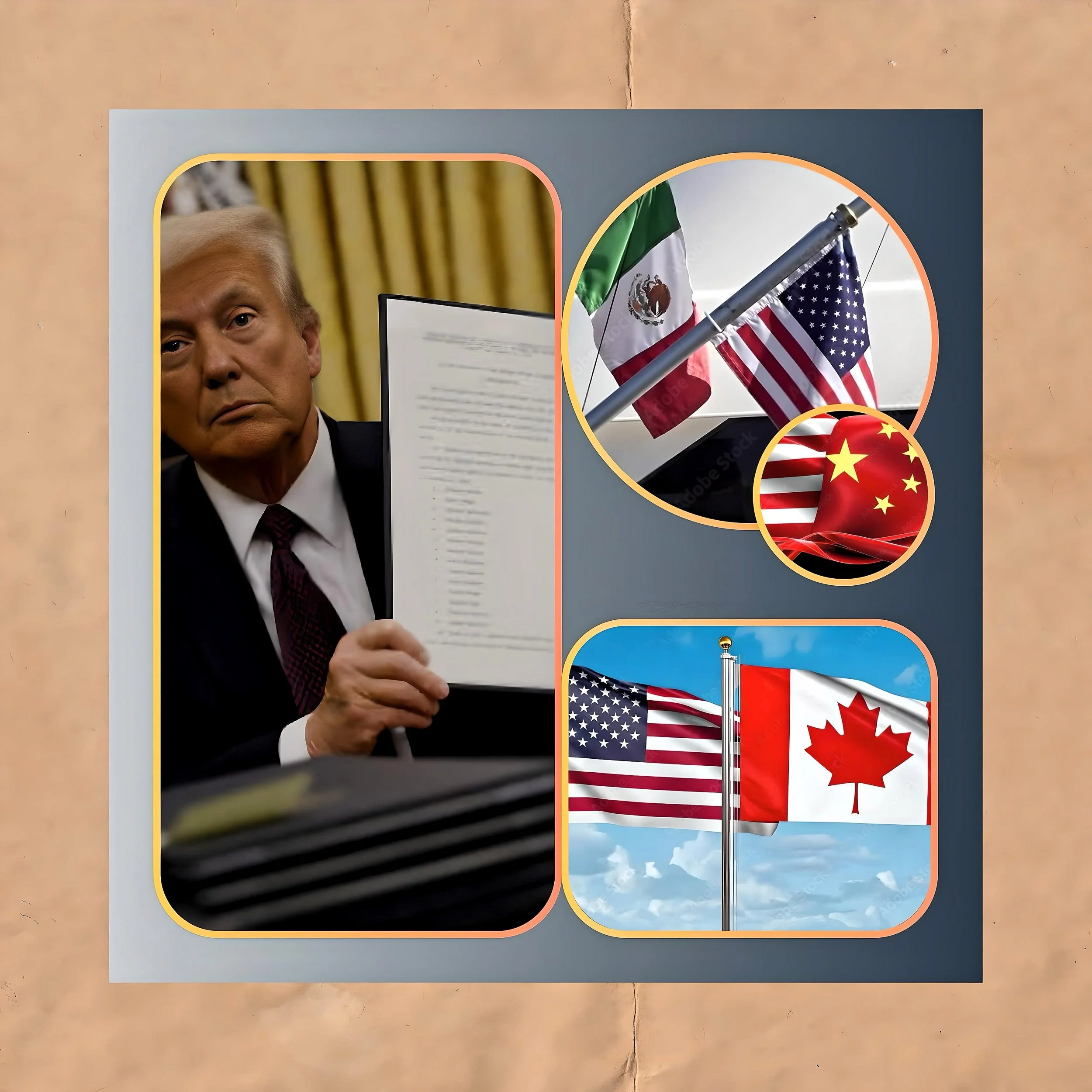

President Donald Trump’s recent imposition of tariffs—25% on Canadian and Mexican imports and 10% on Chinese goods—has created a volatile environment for gold prices, with conflicting forces of dollar strength, inflationary pressures, and safe-haven demand shaping the outlook. Here’s a breakdown of the key factors influencing gold’s trajectory:

Immediate Market Impact

Gold’s Initial Dip

Gold fell below $2,800 early Monday as the U.S. dollar surged to a three-week high, driven by tariffs that heightened demand for the greenback as a haven.

Rebound to Near-Record Levels

Prices later pared losses, stabilizing near all-time highs ($2,817/oz) as investors hedged against trade-war risks and inflationary pressures.

Key Drivers of Gold’s Future Movement

U.S. Dollar Strength vs. Safe-Haven Demand

The dollar’s rally (up 2.3% against the Mexican peso) initially pressured gold by making it pricier for foreign buyers.

However, escalating trade tensions are fueling demand for gold as a traditional hedge. COMEX gold deliveries hit a 2.5-year high (12.9 million troy ounces), signaling strong institutional interest.

Inflationary Pressures

Trump’s tariffs are widely seen as inflationary, which could push the Federal Reserve to maintain higher interest rates. Higher rates typically strengthen the dollar, but gold often gains as a hedge if inflation outpaces rate hikes.

Analysts warn that prolonged tariffs could spike consumer prices in Mexico and Canada, further boosting gold’s appeal.

Technical and Sentiment Indicators

Gold’s RSI (Relative Strength Index) neared overbought territory, suggesting potential short-term consolidation. However, bullish momentum persists, with $3,000/oz cited as a psychological resistance level.

Retail and institutional investors remain optimistic: 72% of traders in a Kitco survey expect gold to hit new highs in the near term.

Geopolitical Escalation Risks

Retaliatory tariffs from Canada, Mexico, and China could deepen the trade conflict, amplifying market uncertainty. For example, Mexico plans counter-tariffs on U.S. goods, while China may challenge the levies at the WTO.

A prolonged standoff could weaken global growth, driving capital into gold and other havens.

Regional Variations

India

Domestic gold prices hit record highs (₹82,815/10g) due to dollar volatility and tariff-driven import costs.

Pakistan

Gold surged to a three-month high ($2,751/oz) amid broader emerging-market anxiety.

Price Forecasts

Short Term

Expect volatility between $2,750 and $2,900/oz, influenced by tariff developments and U.S. economic data (e.g., CPI reports).

Medium Term

A break above $2,800 could propel gold toward $3,000/oz if trade tensions escalate or inflation accelerates.

Conclusion

Gold’s path hinges on the balance between dollar strength and its role as an inflation/geopolitical hedge. While profit-taking and dollar rallies may cause dips, the structural drivers—tariff-related uncertainty, central bank policies, and recession risks—favor upward momentum.

As Ray Dalio noted, “Gold does especially well when paper money is being debased”, a scenario increasingly plausible in today’s trade-war climate.

FAF review

We invite you to review our article analyzing the effects of the recent tariffs imposed by the United States on the stock, forex, and cryptocurrency markets. Additionally, there is a proposal to extend a 10% tariff to European markets. These actions are likely to impact consumers through increased prices, potentially leading to decreased inflation and heightened unemployment rates.

Amidst these economic shifts, national and individual gold reserves are expected to benefit. As a stable and less volatile investment, gold is anticipated to see significant price increases. Our projections suggest gold prices will exceed $4,000 by 2025 and reach $10,000 by 2030.

We encourage you to consider these insights when making investment decisions.