Washington’s Response to Chancellor Merz and the Fiscal Capacity of Germany and France in the Face of Rising Geopolitical Tensions

Introduction

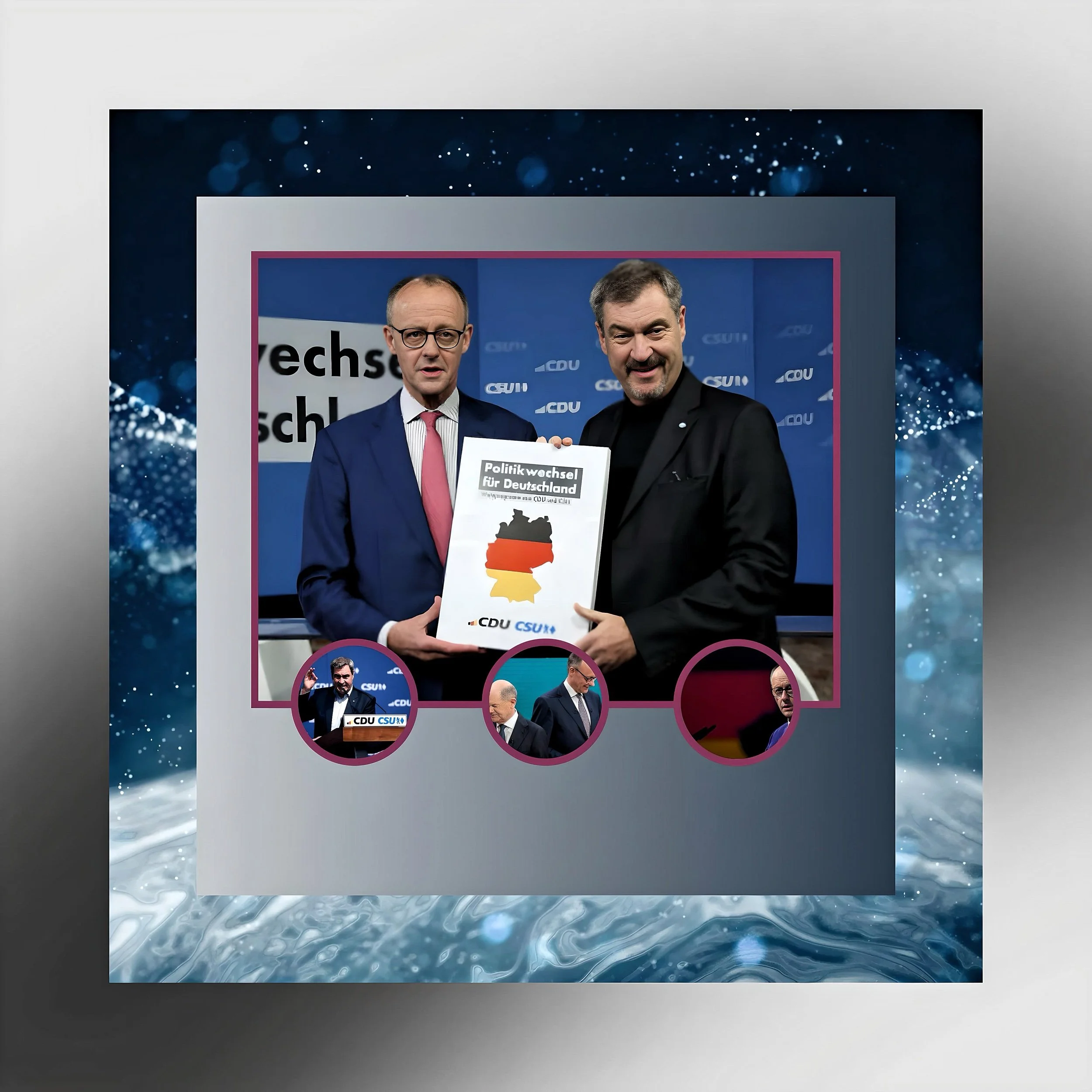

The election of Friedrich Merz as Germany’s chancellor marks a pivotal moment in European politics, with immediate implications for transatlantic relations and the continent’s strategic posture.

Merz’s victory, secured through a coalition-building process that excluded the far-right Alternative for Germany (AfD), has drawn mixed reactions from Washington.

Meanwhile, Germany and France face mounting questions about their ability to sustain defense investments and respond to potential conflicts amid tightening fiscal constraints.

This article analyzes the nuances of Washington’s response to Merz’s leadership and evaluates the economic and strategic capacity of Europe’s two largest economies to navigate a volatile geopolitical landscape.

Washington’s Reaction to Merz’s Election and Policy Agenda

Political Rhetoric and Strategic Divergence

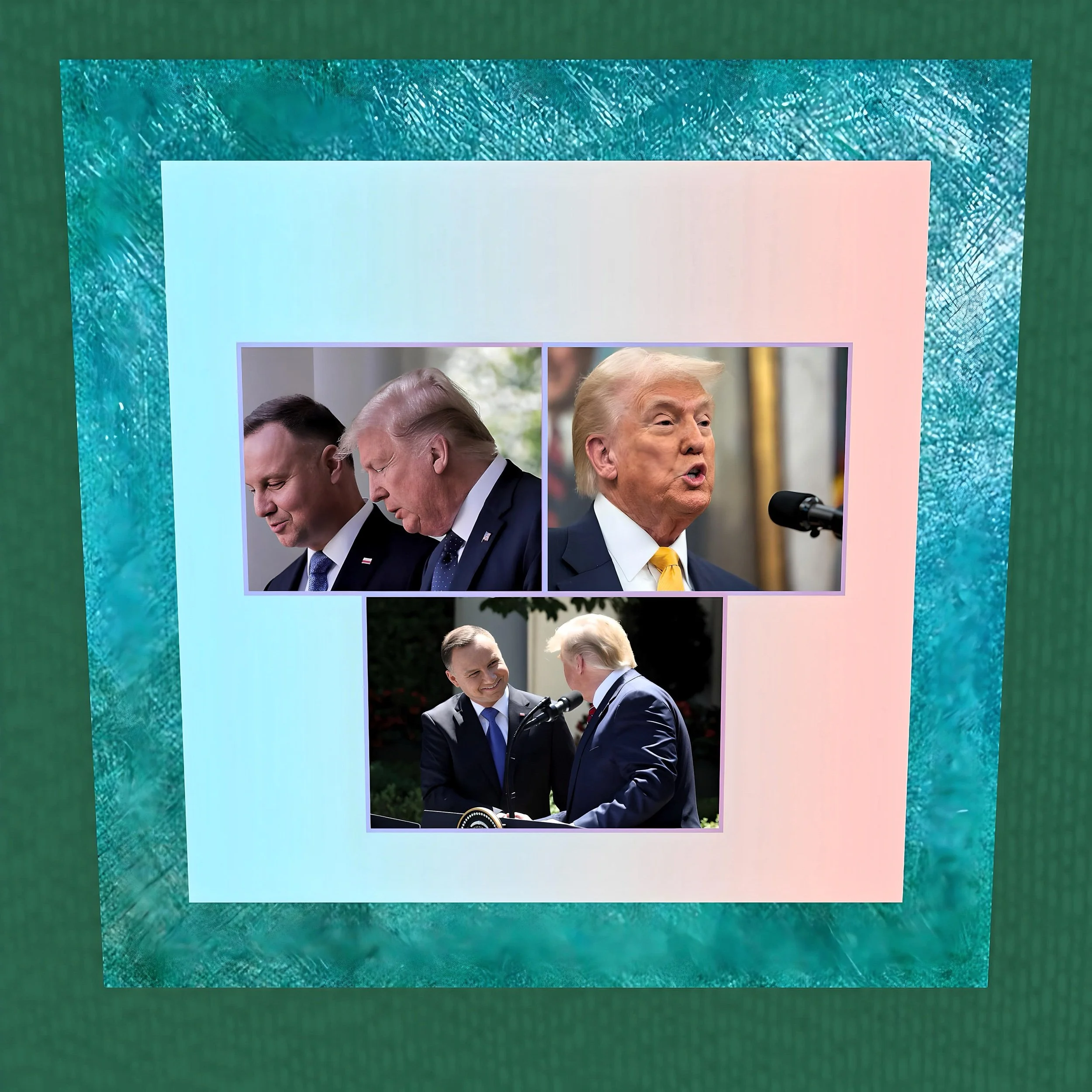

The Trump administration publicly celebrated Merz’s victory, with the former president declaring it a “great day for Germany and the United States” in a social media post.

This enthusiasm stems from Merz’s reputation as a pro-business conservative who shares Trump’s skepticism of multilateral trade frameworks and his hawkish stance toward China.

However, beneath this veneer of camaraderie lies significant friction. Merz has openly criticized U.S. interference in Germany’s electoral process, equating the Trump administration’s actions—including Elon Musk’s alleged meddling—to Russian disinformation campaigns.

During his inaugural address, Merz emphasized that Europe must “achieve independence from the United States,” a sentiment reflecting growing disillusionment with Washington’s transactional approach to NATO and its exclusion of European allies from Ukraine peace negotiations.

The Biden administration, though less vocal, has expressed concern over Merz’s alignment with Trump’s “America First” agenda.

U.S. officials privately worry that Merz’s push for European strategic autonomy could undermine NATO cohesion, particularly as Germany seeks to reduce reliance on U.S. security guarantees.

Vice President JD Vance’s confrontational remarks at the Munich Security Conference, where he accused European leaders of undermining free speech, further strained relations.

These tensions are compounded by Trump’s threats to impose tariffs on European goods, a policy Merz has vowed to counter through EU-wide solidarity.

Economic Priorities and Transatlantic Trade

Washington views Merz’s pro-business background as an opportunity to revitalize economic ties.

Over 96% of German firms plan to expand investments in the U.S., particularly in key battleground states like Texas and Pennsylvania, aligning with Trump’s domestic job creation goals.

However, Merz has signaled resistance to unilateral U.S. trade measures, advocating instead for a “balanced partnership” that protects European industries from punitive tariffs.

This stance reflects broader EU anxieties about U.S. protectionism, especially in sectors like automotive manufacturing and green energy.

The Trump administration’s ambivalence toward European integration complicates matters.

While Merz seeks to strengthen the EU’s internal market and defense capabilities, Washington fears this could dilute U.S. influence.

For instance, Merz’s criticism of the White House’s exclusion of Europe from Ukraine negotiations underscores a broader divergence in strategic priorities.

As one Atlantic Council analyst noted, “Trump wants a strong Europe only insofar as it serves American interests, not as an equal partner”.

Germany’s Fiscal Challenges and Defense Posture

Budget Deficits and the Debt Brake

Germany’s fiscal framework, constrained by a constitutional “debt brake” limiting deficits to 0.35% of GDP, poses significant hurdles to Merz’s ambitions.

The previous government collapsed in late 2024 after failing to reconcile a €25 billion budget shortfall, with debates over defense spending exacerbating coalition tensions.

The 2025 budget allocates €58 billion for defense, falling short of Defense Minister Boris Pistorius’s €78 billion request.

Merz now faces pressure to fund critical military modernization projects, including the €100 billion special fund established in 2022, while adhering to fiscal conservatism demanded by his CDU base.

The debt brake’s rigidity has drawn criticism from economists who argue it stifles strategic investments.

Suspending the rule would require declaring a national emergency—a politically fraught move given Germany’s aversion to deficit spending.

Merz has thus far resisted such measures, instead advocating for austerity in social programs to free up defense funds.

However, this approach risks public backlash, particularly as inflation and energy costs strain households.

Defense Spending and Strategic Recalibration

Despite fiscal constraints, Merz has pledged to meet NATO’s 2% GDP defense spending target, a commitment underscored by the Zeitenwende (“turning point”) initiated under former Chancellor Olaf Scholz.

Germany’s current defense expenditure of 2.1% GDP lags behind France (2.3%) and the UK (2.5%), but Merz aims to close this gap by prioritizing procurement of advanced weaponry like the F-35 fighter jet and bolstering cyber defenses.

A Bruegel Institute study estimates that Germany would need an additional €145 billion annually to achieve full strategic autonomy from the U.S., a figure far exceeding current allocations.

Merz’s reliance on EU-wide defense collaboration—such as joint procurement initiatives and the European Defence Fund—could mitigate costs, but progress remains slow due to bureaucratic hurdles.

France’s Austerity Measures and Military Commitments

Fiscal Crisis and Defense Prioritization

France is currently navigating a complex landscape where its fiscal challenges and military commitments intersect, creating tension between austerity measures and defense prioritization.

As of February 25, 2025, the country faces a significant fiscal crisis, with a ballooning national deficit and debt levels that have raised alarm bells both domestically and within the European Union.

At the same time, France remains committed to its military ambitions, including meeting NATO spending targets and supporting strategic objectives like aiding Ukraine and preparing for potential high-intensity conflicts.

This duality has forced the government into a delicate balancing act.

On the fiscal side, France is grappling with a deficit projected to hit 5.5% of GDP in 2025, up from earlier targets, and a national debt approaching 115% of GDP.

The government, led by Prime Minister Michel Barnier until his recent ousting in December 2024, introduced a 2025 budget aiming to cut €60 billion through a mix of spending reductions and tax hikes, primarily targeting social programs and the wealthy.

However, political instability—exemplified by the collapse of Barnier’s government after a no-confidence vote—has jeopardized these plans.

The use of Article 49.3 to bypass parliamentary approval underscored the depth of the crisis, but concessions to opposition demands, like pension indexation, have weakened fiscal consolidation efforts. With no new elections possible until mid-2025, France risks prolonged uncertainty, potentially relying on emergency measures to manage its finances.

Meanwhile, defense remains a priority despite these constraints.

France has committed to a military spending increase, with its 2024-2030 Military Programming Law allocating €413 billion to modernize its forces—a 40% jump from the previous cycle. This has pushed defense spending to 2.1% of GDP in 2024, meeting NATO’s minimum threshold, with forecasts suggesting a rise to $64 billion in 2025 and $67.8 billion by 2029.

President Emmanuel Macron has championed this buildup, emphasizing readiness for “high-intensity conflict” and closing capability gaps exposed by the Ukraine war, such as in drones and munitions production.

Yet, there’s talk of even steeper increases, with speculation that spending could climb to 5% of GDP—a move that would strain an already fragile economy without significant trade-offs elsewhere.

The fiscal crisis limits France’s wiggle room. Interest payments on debt are set to outpace even defense spending in the coming years, and economic growth forecasts have been downgraded to 0.7% for 2025, below the government’s optimistic 1.1%.

This makes ambitious military expansion tricky—raising spending by another 3% of GDP would likely require either deeper cuts to welfare, health, and pensions (already politically contentious) or higher taxes, risking further unrest.

Recruitment challenges also loom large, with personnel spending growth lagging behind hardware investments, hinting at deeper structural issues.

Geopolitically, France’s commitments add pressure. Its role in NATO, support for Ukraine, and ambitions in the Indo-Pacific demand resources, but the current political gridlock—coupled with a caretaker government under François Bayrou—casts doubt on execution.

The upcoming NATO summit in June 2025 may push for a 2.5% GDP spending floor, or even 3% by 2030, a target France could struggle to meet without resolving its fiscal woes. Investors are jittery, with bond spreads widening to levels unseen since the 2012 eurozone crisis, reflecting skepticism about France’s ability to square this circle.

In short, France’s austerity measures and military goals are on a collision course.

The government must either find a way to boost growth and stabilize politics to fund its defense vision or scale back ambitions—a choice that’s as much about national identity as it is about numbers.

For now, the tension remains unresolved, with the specter of a caretaker administration muddling the path forward.

Industrial Capacity and War Readiness

France’s defense industry, though robust, faces production bottlenecks.

The 2024-2030 Military Programming Law (LPM) allocates €413 billion to modernize armed forces, but labor strikes and supply chain disruptions have delayed key projects like the FCAS fighter jet.

Barnier’s government has introduced “war economy” measures to accelerate production, including tax incentives for defense contractors and streamlined procurement processes.

These steps aim to bolster France’s capacity to sustain prolonged conflict, though experts question whether they can offset systemic inefficiencies.

Comparative Analysis: Can Germany and France Afford a Major Conflict?

Economic Vulnerabilities

Both nations face severe fiscal constraints that would complicate wartime mobilization. Germany’s debt brake limits its ability to borrow for defense emergencies, while France’s soaring debt servicing costs (€50 billion annually) divert funds from critical infrastructure and social programs.

A protracted conflict would exacerbate these pressures, forcing governments to choose between military spending and economic stability.

Industrial and Logistical Limits

Germany’s defense industry, though technologically advanced, lacks the scale for rapid mobilization.

Chronic underinvestment has left stockpiles depleted, with reports indicating that the Bundeswehr has barely enough ammunition for two days of intense combat.

France’s situation is marginally better due to longer-standing investment in autonomous capabilities, but its defense sector remains reliant on imported components vulnerable to supply chain disruptions.

Strategic Interdependence

Neither country can realistically confront a peer adversary like Russia without U.S. support.

Germany’s air defense systems depend on U.S.-made Patriots, while France’s nuclear deterrent requires American intelligence sharing. Merz’s vision of European autonomy thus hinges on unprecedented EU integration—a prospect undermined by political fragmentation and competing national interests.

Conclusion

Navigating a Precarious Balance

The Merz chancellorship heralds a shift toward greater European assertiveness, but Washington’s mixed reactions reflect underlying anxieties about NATO’s future.

While Trump applauds Merz’s victory as a validation of his populist agenda, strategic divergences over trade, defense, and Ukraine threaten to strain transatlantic ties.

Germany and France, despite their fiscal woes, have little choice but to prioritize defense in the face of existential threats.

However, their capacity to wage sustained conflict remains constrained by structural economic weaknesses and industrial limitations.

The path forward requires balancing austerity with strategic investments, leveraging EU collaboration to pool resources, and redefining transatlantic partnerships to accommodate Europe’s growing autonomy.

As Merz himself acknowledged, “Independence is not isolation—it is the precondition for a mature partnership with Washington”.

The coming years will test whether rhetoric can align with reality in an increasingly fractured world.