What is Somaliland Socio-economic and political background - 2025?

Introduction

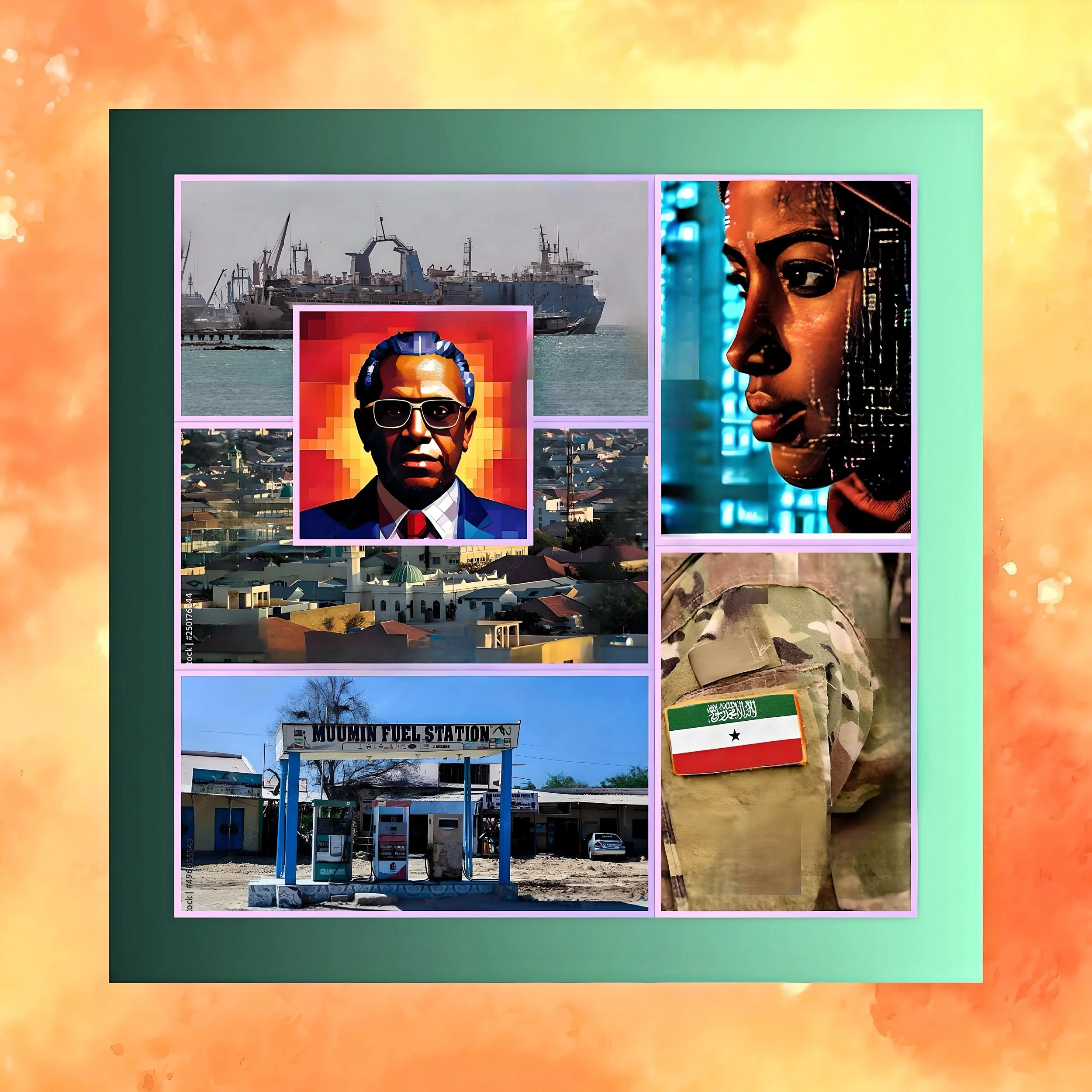

Somaliland’ Socio-Economic and Political Landscape in 2025: A Comprehensive Analysis

Somaliland, a self-declared independent state in the Horn of Africa, continues to navigate a complex socio-political and economic landscape in 2025.

Despite lacking international recognition, it has solidified its reputation as a stable, democratic entity in a volatile region.

This article examines Somaliland’s political evolution, economic challenges, social dynamics, and recent developments, drawing on its hybrid governance model, economic resilience, and ongoing quest for legitimacy.

Historical and Political Foundations

From Clan-Based Governance to Democratic Transitions

Somaliland’s political identity traces back to its brief independence in 1960 before uniting with Somalia.

The collapse of Siad Barre’s regime in 1991 led to its declaration of independence, anchored in clan-driven reconciliation efforts.

The 2001 constitution institutionalized a hybrid system blending traditional elders (Guurti) and modern democratic institutions.

This framework enabled peaceful power transitions, exemplified by the 2024 presidential election where opposition leader Abdirahman Mohamed Abdullahi (Irro) of the Waddani party secured 64% of the vote, ending 14 years of rule by the Kulmiye party.

The election, delayed by two years due to financial and technical constraints, was praised as free and fair by international observers. Irro’s victory signaled public demand for equitable governance, moving away from perceived centralization and clan favoritism under outgoing President Muse Bihi.

The peaceful transfer of power underscored Somaliland’s democratic resilience, contrasting sharply with regional authoritarianism.

Clan Dynamics and Institutional Challenges

Clan politics remain central to Somaliland’s stability. The constitutional limit of three political parties prevents fragmentation but risks marginalizing minority clans.

The 2022–2024 Las Anod conflict, where SSC-Khatumo forces sought autonomy, highlighted tensions over resource allocation and political representation.

The new administration faces pressure to address clan-based grievances through dialogue rather than militarization, a shift from Bihi’s hardline approach.

The judiciary and electoral systems also face challenges. The National Electoral Commission, perceived as politicized, requires reform to ensure independence.

President Irro has pledged to depoliticize institutions and reduce the licensing cycle for political associations from ten to five years, fostering inclusivity.

Economic Landscape: Resilience Amid Structural Constraints

Structural Vulnerabilities and Livestock Dependency

Somaliland’s economy remains fragile, with a GDP of $7.6 billion (2024) and per capita income of $1,361. Livestock accounts for 50% of GDP, while remittances from the diaspora ($1 billion annually) sustain households.

GDP is expected to grow to $8.1 Billion by end of 2025.

Youth unemployment exceeds 70%, driving migration and “brain drain”.

Limited access to international finance due to non-recognition exacerbates these challenges, barring loans from the IMF and World Bank.

Somaliland's economy is predominantly driven by the following sectors:

Livestock

This is the backbone of Somaliland's economy, with livestock exports being the primary source of foreign exchange. Sheep, goats, camels, and cattle are exported mainly to the Gulf states, including Saudi Arabia, UAE, and Oman. Livestock markets in places like Burao and Yirowe are significant, handling animals from across the Horn of Africa.

Agriculture

Although not as dominant as livestock, agriculture plays a significant role, particularly in regions where rain-fed farming or irrigation is viable. Products include sorghum, maize, sesame, cowpeas, vegetables, and fruits. Agriculture contributes to both domestic consumption and export, albeit to a lesser extent than livestock.

Services

This sector, including wholesale and retail trade (much of it informal), accounts for a substantial portion of employment and economic activity. The service sector has grown with improvements in telecommunications, banking (despite its informal nature due to lack of international recognition), and other services.

Telecommunications

Somaliland has a vibrant telecom sector, with several companies providing mobile service, internet, and sometimes TV broadcasting. This sector has significantly contributed to the economy by improving communication infrastructure.

Remittances

While not an economic sector per se, remittances from the Somali diaspora are crucial, contributing a significant amount to the economy. Companies like Dahabshiil are instrumental in facilitating these transfers, which support household incomes and local businesses.

Mining and Minerals

Somaliland has untapped potential in minerals, including lithium and rare earth minerals. There are indications of interest from foreign companies for exploration and extraction, which could diversify the economy if fully developed.

Energy

There's an emerging focus on renewable energy, particularly solar, to meet the country's energy needs. Investments in this sector are aimed at supporting economic growth and addressing the high cost and unreliability of electricity.

Fisheries

With its strategic location along the Gulf of Aden, Somaliland has potential in fishing, although this sector is less developed compared to livestock and agriculture.

Tourism

While nascent, there's potential for growth, especially in areas with historical significance or natural beauty like Laas Geel rock art and coastal areas.

Trade and Transport

The Port of Berbera has been a focal point for economic activity, especially after agreements with DP World for development and management.

This enhances Somaliland's role as a trade gateway, particularly for Ethiopia.

These sectors are pivotal in shaping Somaliland's economy, with livestock and agriculture being traditional strongholds, while services, remittances, and emerging sectors like energy and minerals offer new avenues for growth and economic diversification.

Strategic Investments and Development Initiatives

To diversify its economy, Somaliland has prioritized infrastructure projects:

Port of Berbera

Managed by DP World, this $1 billion project aims to transform Berbera into a regional trade hub. Ethiopia’s 19% stake and 2024 agreement to lease coastline for naval access have intensified regional tensions but bolstered Somaliland’s geopolitical leverage.

Berbera Corridor

UAE-funded road upgrades connect the port to Ethiopia, enhancing trade potential.

Vision 2030

Focuses on modernizing livestock sectors, expanding renewable energy, and attracting foreign investment.

Despite these efforts, 40% of children face malnutrition, and maternal mortality rates remain alarmingly high at 732 per 100,000 births.

The Somaliland Development Fund (SDF) has improved infrastructure for 1.4 million people, but healthcare and education systems remain under-resourced.

Social Dynamics and Human Development

Education and Healthcare Gaps

Only 34% of primary-aged children attend school, with rural illiteracy at 70%.

Education relies heavily on diaspora-funded NGOs, lacking standardized curricula.

Healthcare is precarious: 80% of births occur outside hospitals, and life expectancy is 56 years.

The Gabooye minority and other marginalized groups face systemic exclusion from political and economic opportunities.

Clan Networks as Social Safety Nets

Traditional clan structures provide dispute resolution and resource redistribution, yet reinforce inequalities. The Guurti (House of Elders) mediates conflicts but struggles to address modern governance challenges, such as urban unemployment and youth disillusionment.

Recent Developments and Regional Implications

2024 Elections and Democratic Consolidation

Irro’s administration prioritizes inclusive governance, resolving the Las Anod conflict, and lobbying for international recognition. His criticism of the opaque Ethiopia port deal reflects a balanced approach to foreign policy, seeking to align economic benefits with public transparency.

Geopolitical Maneuvering and Recognition Quest

Somaliland’s 2024 Memorandum of Understanding (MoU) with Ethiopia, granting Addis Ababa coastline access in exchange for potential recognition, has reshaped regional dynamics.

While Ethiopia’s endorsement could catalyze broader recognition, it has inflamed tensions with Somalia, which condemned the deal as a violation of sovereignty.

The AU and EU have urged restraint, fearing precedent-setting for secessionist movements.

U.S. Trump administration presents a pivotal opportunity. Trump’s advisors have signaled interest in recognition, leveraging Somaliland’s strategic Red Sea position to counter Chinese influence and enhance counterterrorism efforts.

However, such a move risks destabilizing Somalia and empowering groups like Al-Shabaab.

Conclusion

Prospects and Challenges

Somaliland’s hybrid governance model and economic pragmatism have fostered stability unmatched in Somalia. However, international recognition remains elusive, curtailing access to development finance. The 2024 electoral transition offers hope for reforms, yet clan politics, youth unemployment, and regional tensions persist.

Recommendations

Conditional Recognition

Tie recognition to democratic consolidation, human rights progress, and inclusive governance.

Economic Diversification

Expand fisheries, renewable energy, and digital infrastructure to reduce livestock dependency.

Social Investment

Partner with NGOs to standardize education and healthcare, targeting maternal and child health.

As Somaliland navigates its quest for legitimacy, balancing traditional clan legitimacy with modern state-building will determine its trajectory in the Horn of Africa’s volatile geopolitics.