Africa are you aware you are caught in web of Chinese debt trap? What is debt trap?

Introduction

The concept of “debt trap diplomacy” in Africa, particularly regarding Chinese loans, suggests that several countries may be at risk of falling into unsustainable debt levels due to extensive borrowing from China. Here are the key points regarding the situation

As of 2024, the total debt Africa owes to China is approximately $90 billion.

This figure represents a significant portion of Africa’s external debt and has been a subject of concern due to its rapid growth over the past two decades.

Countries at Risk

Countries with High Debt to China: Several African nations have significant debts to China, which raises concerns about their financial sustainability. Notable examples include:

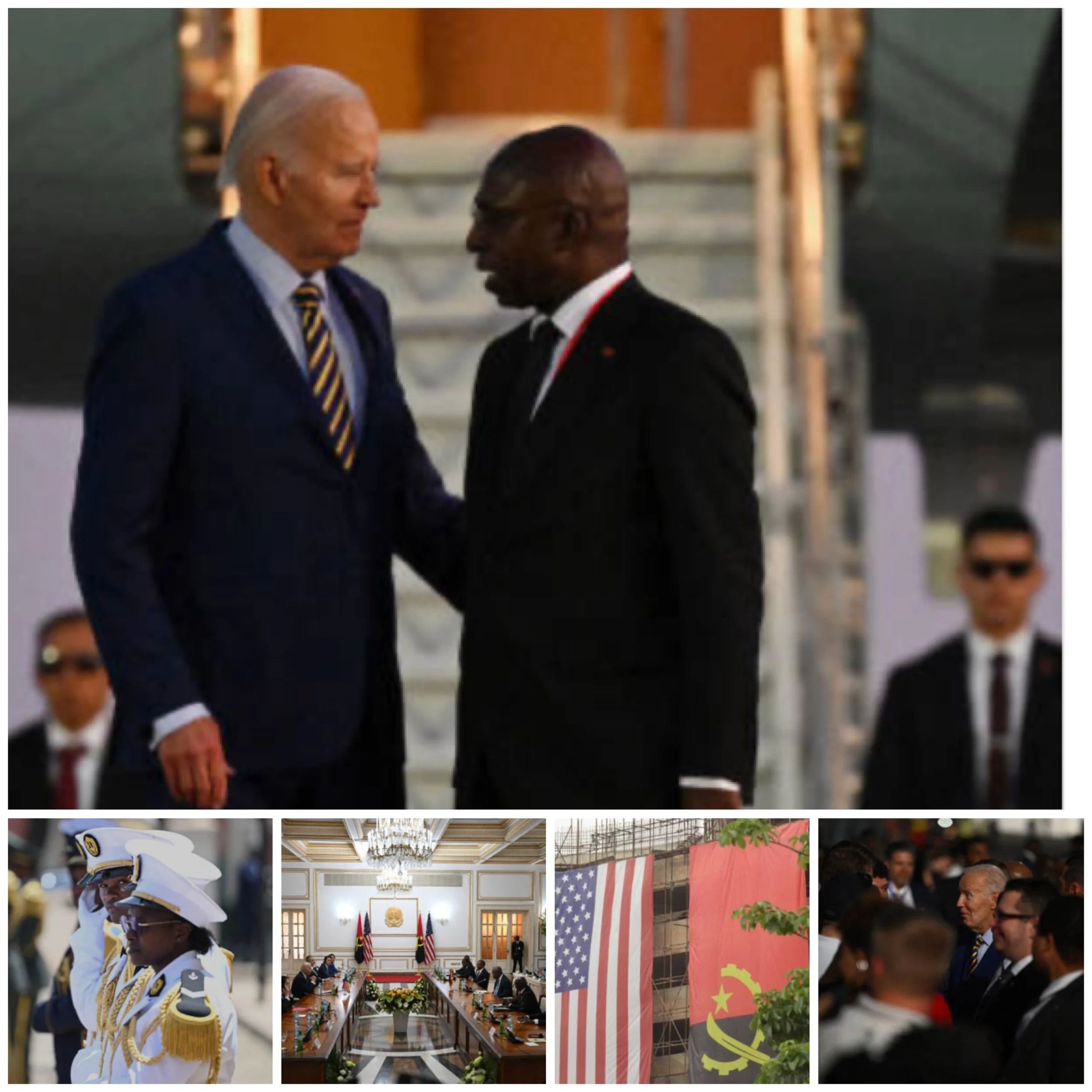

Angola: Approximately $25 billion

Ethiopia: About $13.5 billion

Zambia: Roughly $7.4 billion

Republic of the Congo: Around $7.3 billion

Sudan: About $6.4 billion.

Debt Distress

As of late 2022, the World Bank identified seven African countries as being in debt distress or at high risk of distress due to their Chinese loans. In total, 22 low-income African countries are currently either in debt distress or at high risk of it.

Broader Context

Total Loans

Between 2000 and 2022, China has extended loans exceeding $170 billion to 49 African countries. This has contributed to rising debt-to-GDP ratios, with many countries projected to exceed a 60% ratio.

Debt Management Issues

While Chinese loans are a factor, many African countries also struggle with overall debt management, not solely from Chinese creditors. Poor governance and economic conditions exacerbate these challenges.

Perception vs. Reality

The narrative around “debt traps” may be influenced by geopolitical tensions, particularly between China and Western nations. Some analysts argue that while concerns exist regarding transparency and repayment terms, the notion of a deliberate strategy by China to ensnare African nations in debt is overly simplistic.

Conclusion

Several African countries are indeed facing significant debts to China and risks associated with those debts, the situation is complex and influenced by various factors beyond just Chinese lending practices.