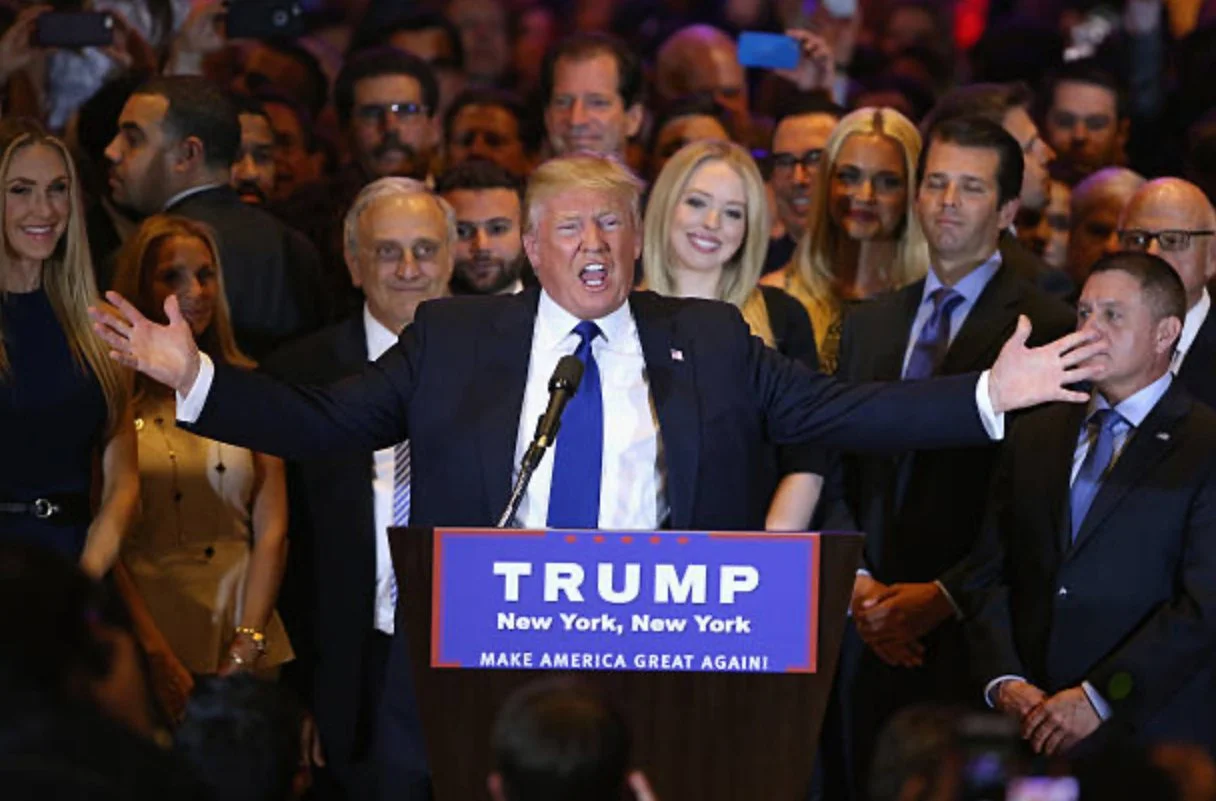

Chinese Business in cold feet - on Trump win

Chinese suppliers are indeed deeply concerned about the possibility of Donald Trump winning the upcoming U.S. presidential election. Their worries stem from Trump’s proposed trade policies, which could significantly impact their businesses. Here’s an overview of the situation:

Tariff Concerns

Trump has proposed imposing tariffs of 60% or more on all goods imported from China if he returns to office. This potential “Tariff War 2.0” has Chinese manufacturers and exporters extremely anxious about their future prospects in the U.S. market.

Impact on Competitiveness

Many Chinese business owners fear that such substantial tariffs would render their products uncompetitive in the U.S. market. For example:

• Li Wei, who runs a glass manufacturing ncompany in Cangzhou, stated that a significant tariff increase would “undoubtedly have a significant effect” on his business and could cause U.S. sales to plummet.

• Dong Sion, a sales manager at Sotech, a Shanghai-based electronics manufacturer, warned that a 60% tariff could disrupt or even completely terminate their U.S. operations.

Economic Consequences

The proposed tariffs could have far-reaching consequences for Chinese businesses and the broader Chinese economy:

• Gary Ng, a senior economist at Natixis, indicated that many Chinese manufacturers would find it impossible to remain competitive or turn a profit in the U.S. market with 60% tariffs.

• The tariffs could exacerbate already challenging economic conditions in China, potentially leading to workforce reductions and business closures.

Seeking Alternatives

In response to these potential challenges, Chinese suppliers are actively exploring ways to mitigate the impact:

• Some businesses, like Li Wei’s, are working to find alternative export markets to offset potential losses in U.S. sales.

• Others are considering relocating production to countries like Mexico, although Trump has also threatened high tariffs on Mexican imports.

Broader Economic Impact

The proposed tariffs would not only affect Chinese suppliers but could also have significant implications for the U.S. economy:

• An analysis by the Peterson Institute for International Economics estimated that these measures could lead to a 0.4% increase in inflation by 2025 and a 0.23% decrease in GDP by 2027 in the U.S.

In conclusion, Chinese suppliers are deeply worried about the potential consequences of a Trump victory, given his proposed tariff policies. These concerns extend beyond individual businesses to the broader Chinese economy, highlighting the significant stakes involved in the upcoming U.S. election for China’s export-oriented industries.

Chinese suppliers are understandably feeling a deep sense of concern about the possibility of Donald Trump winning the upcoming U.S. presidential election. Their anxieties are rooted in Trump’s proposed trade policies, which include the potential for imposing tariffs of 60% or more on all goods imported from China if he returns to office. This looming prospect of a “Tariff War 2.0” has left many Chinese manufacturers and exporters feeling extremely anxious about their future in the U.S. market.

Impact on Competitiveness

Many Chinese business owners are worried that such significant tariffs could make their products uncompetitive in the U.S. market. For instance, Li Wei, who runs a glass manufacturing company in Cangzhou, expressed that a major tariff increase would “undoubtedly have a significant effect” on his business and could lead to a drastic decline in U.S. sales. Similarly, Dong Sion, a sales manager at Sotech, an electronics manufacturer based in Shanghai, cautioned that a 60% tariff might disrupt or even completely halt their U.S. operations.

Economic Consequences

The proposed tariffs could have far-reaching implications for Chinese businesses and the overall Chinese economy. Gary Ng, a senior economist at Natixis, pointed out that many Chinese manufacturers might struggle to remain competitive or turn a profit in the U.S. market if faced with such high tariffs. This situation could worsen the already challenging economic conditions in China, potentially resulting in workforce reductions and business closures.

Seeking Alternatives

In light of these potential challenges, Chinese suppliers are actively seeking ways to mitigate the impact. Some businesses, like Li Wei’s, are exploring alternative export markets to help offset potential losses in U.S. sales. Others are contemplating relocating production to countries like Mexico, though they are also mindful of Trump’s threats regarding high tariffs on Mexican imports.

Broader Economic Impact

The proposed tariffs would not only affect Chinese suppliers but could also have significant implications for the U.S. economy. An analysis by the Peterson Institute for International Economics estimated that these measures could lead to a 0.4% increase in inflation, further complicating the economic landscape. It’s clear that many are genuinely worried about the potential consequences of a Trump victory, given his proposed tariff policies. These concerns extend beyond individual businesses to the broader Chinese economy, underscoring the significant stakes involved in the upcoming U.S. election for China’s export-oriented industries.