How will the decrease in interest rates impact Saudi Arabia's economy

Introduction

The recent decrease in interest rates from 5.25% and 4.75, is expected to have a significant positive impact on Saudi Arabia’s economy, affecting various sectors and supporting the country’s economic diversification efforts. Here’s an overview of the anticipated effects:

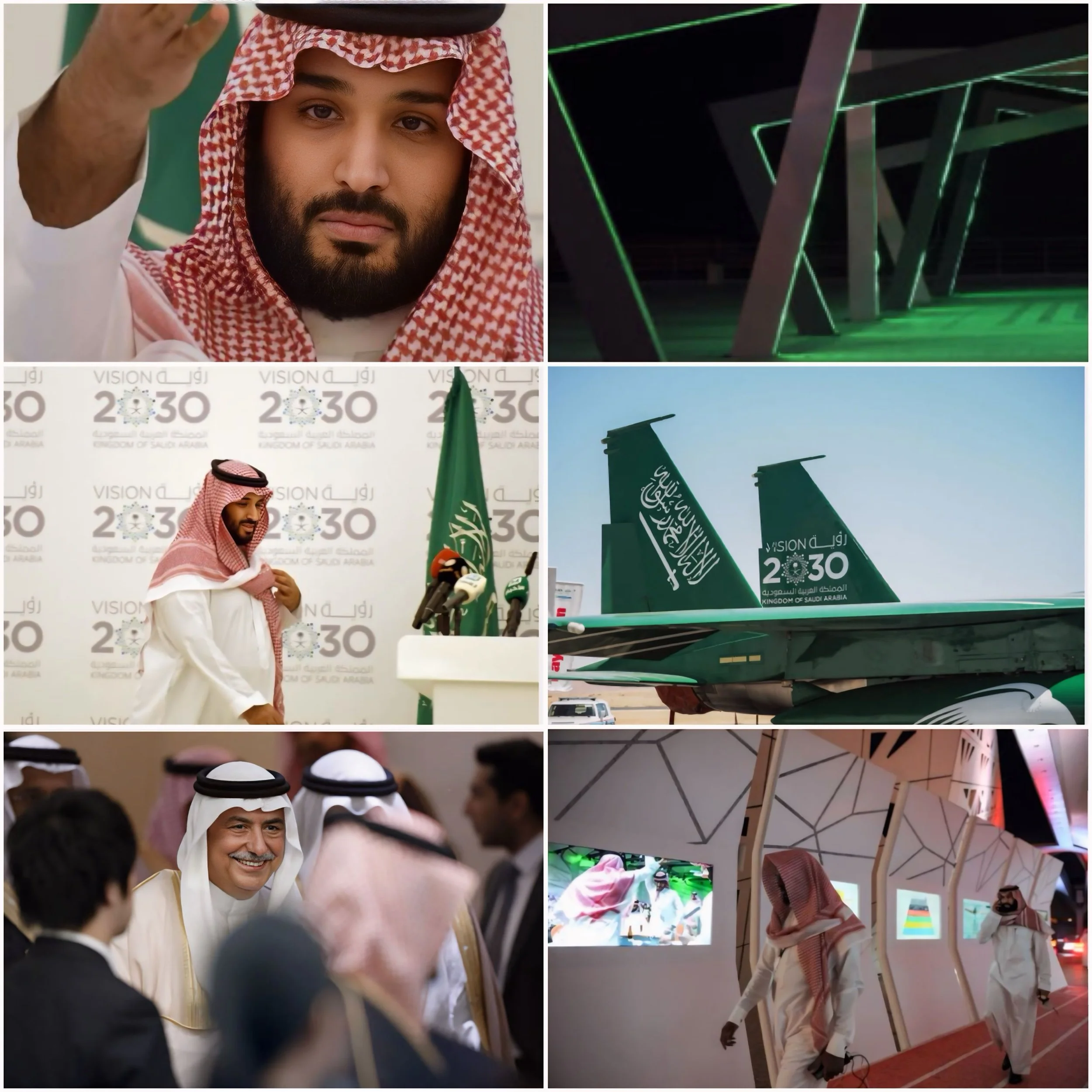

Economic Growth and Vision 2030

The interest rate cut is likely to boost Saudi Arabia’s economic growth and support the objectives of Vision 2030:

GDP Growth:

Experts predict a GDP boost of between $9 billion and $14 billion.

Job Creation:

The rate cut could contribute to the creation of 1.5 million new jobs.

Non-Oil Sector Growth:

Lower interest rates are expected to accelerate non-oil activities, supporting Saudi Arabia’s economic diversification efforts.

Business and Investment

The reduction in interest rates is anticipated to stimulate business activity and investment:

Cheaper Credit:

Businesses, especially in capital-intensive sectors like real estate, construction, and infrastructure, will benefit from more affordable borrowing.

Project Funding: The rate cut will support funding for Vision 2030 projects and other ongoing initiatives.

Foreign Investment:

Successive rate cuts are expected to attract more foreign investment and increase cash flows into the stock market.

Banking and Financial Sector

Saudi banks are well-positioned to benefit from the interest rate cuts:

Profit Growth:

Banks are expected to see a significant increase in profit margins in early 2025.

Competitive Advantage:

Saudi banks enjoy higher valuations and conservative leverage, giving them an edge over Gulf counterparts.

Lending Growth:

Fitch Ratings anticipates Saudi banks will continue to grow at roughly double the average rate of the GCC, with projected financing growth of about 12% for 2024.

Real Estate and Housing

The real estate sector is likely to experience growth due to lower interest rates:

Affordable Mortgages:

Lower rates will make mortgages and property financing more accessible to consumers.

Market Growth:

The real estate market, which has seen a 5% price increase since 2020, could experience further growth.

Consumer Spending and Inflation

The rate cut is expected to impact consumer behavior and potentially influence inflation:

Increased Spending:

Lower interest rates are likely to boost domestic spending and improve corporate cash flow.

Inflation Risk:

The combination of rate cuts and ongoing economic stimulus could potentially spark inflationary pressures, particularly in the housing sector.

Conclusion

the decrease in interest rates is expected to have a broad positive impact on Saudi Arabia’s economy, supporting growth across multiple sectors and advancing the country’s Vision 2030 objectives. However, policymakers will need to monitor potential inflationary pressures and manage the balance between stimulating growth and maintaining economic stability.