Is Chinese laying a financial trap for Saudi given the trend with China

Introduction

The $2 billion bond issuance by China in Saudi Arabia is not inherently a “trap” like some have characterized Chinese investments in other nations. Rather, it represents a strategic financial move that benefits both countries while deepening their economic ties. Here’s a more nuanced look at the situation:

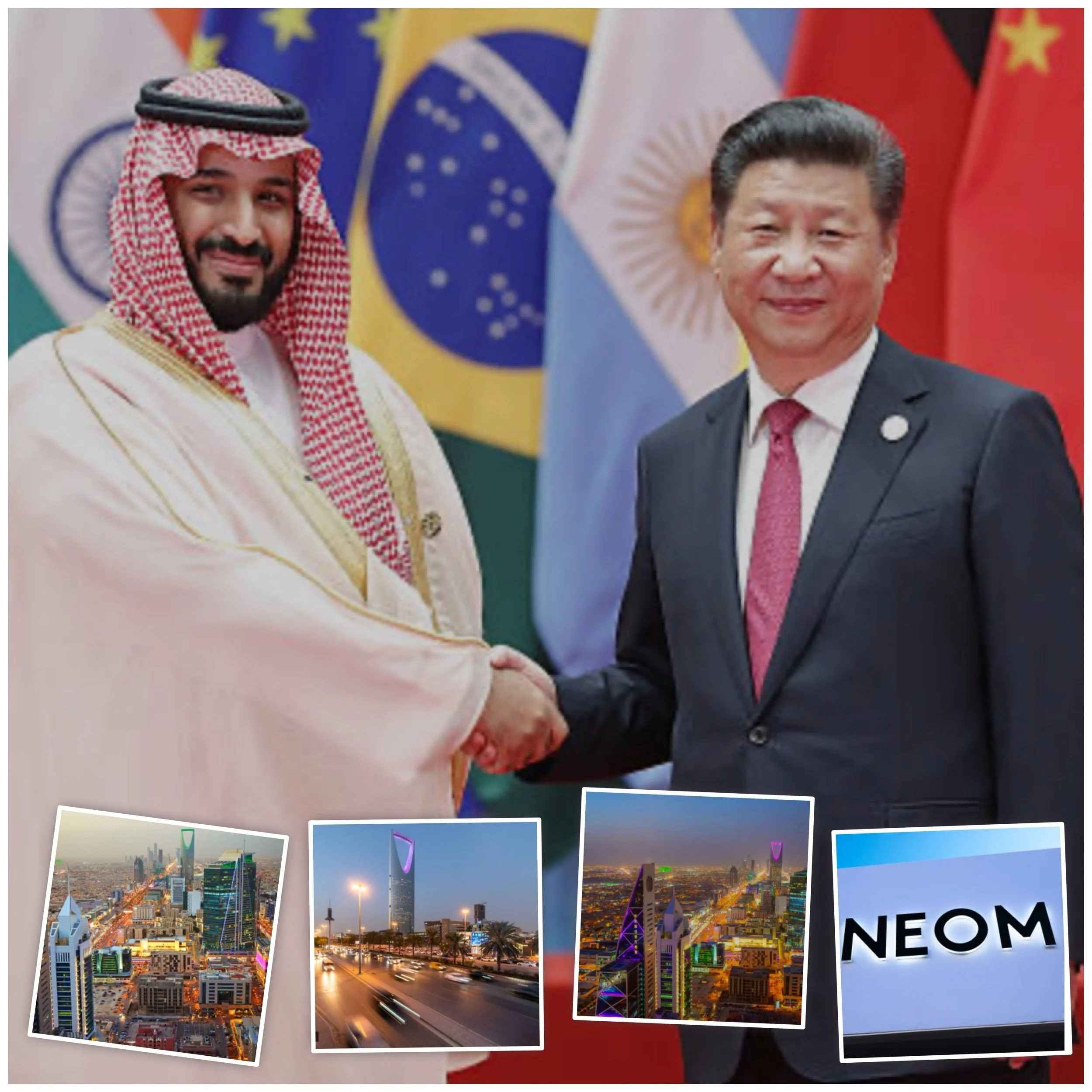

Strategic Partnership

China’s decision to issue dollar-denominated bonds in Saudi Arabia for the first time in three years is a calculated move to strengthen the Sino-Saudi relationship. This bond issuance aligns with broader efforts by both nations to enhance their economic cooperation and diversify their financial partnerships.

Benefits for Saudi Arabia

Vision 2030 Support The bond issuance demonstrates China’s support for Saudi Arabia’s ambitious Vision 2030 initiative, which aims to diversify the Kingdom’s economy away from oil dependence. This move is likely to increase liquidity in the Saudi market and bolster investor confidence in the Kingdom’s financial capabilities.

Financial Sector Development For Saudi Arabia, this bond issuance validates its economic reforms and positions it as an emerging center of financial activity in the Gulf region. It supports the Kingdom’s efforts to attract foreign investment and create an environment conducive to economic growth.

China’s Strategic Interests

Economic Diversification For China, this move represents an effort to diversify its financial strategies away from traditional Western-centric institutions. It’s part of China’s broader Belt and Road Initiative (BRI) to build and foster alternative financial centers globally.

Energy Security China sees Saudi Arabia as a reliable partner for its energy security needs. Saudi Arabia, as one of the world’s largest oil producers, has consistently supplied oil to China.

Mutual Benefits

The bond issuance is part of a larger pattern of growing economic ties between China and Saudi Arabia. Bilateral trade reached $97 billion in 2023, with China being Saudi Arabia’s largest trade partner since 2014. Chinese investments in Saudi Arabia have also surged, rising from $1.5 billion in 2022 to $16.8 billion in 2023.

Not a Debt Trap

Unlike some Chinese investments in other countries that have been criticized as “debt traps,” this bond issuance is different:

1. It’s China issuing bonds in Saudi Arabia, not lending money to Saudi Arabia.

2. Saudi Arabia is a wealthy nation with a strong economy, unlike some smaller countries that have struggled with Chinese debt.

3. The bond issuance is relatively small ($2 billion) compared to the overall economic relationship between the two countries.

Conclusion

While it’s important to approach any major financial move with caution, characterizing this bond issuance as a “trap” would be an oversimplification. It appears to be a mutually beneficial arrangement that deepens economic ties between two major global powers, each pursuing its own strategic interests. However, as with any significant financial decision, it will be crucial to monitor the long-term impacts and ensure that both parties continue to benefit equitably from this growing economic partnership